Below is a San Diego housing update my financial planning

firm sent to our clients and friends. (If you’d like to sign up for

our quarterly updates, you can do so here). Stick around

for some bonus pigg-only graphs at the end.

Measuring

housing

expensiveness

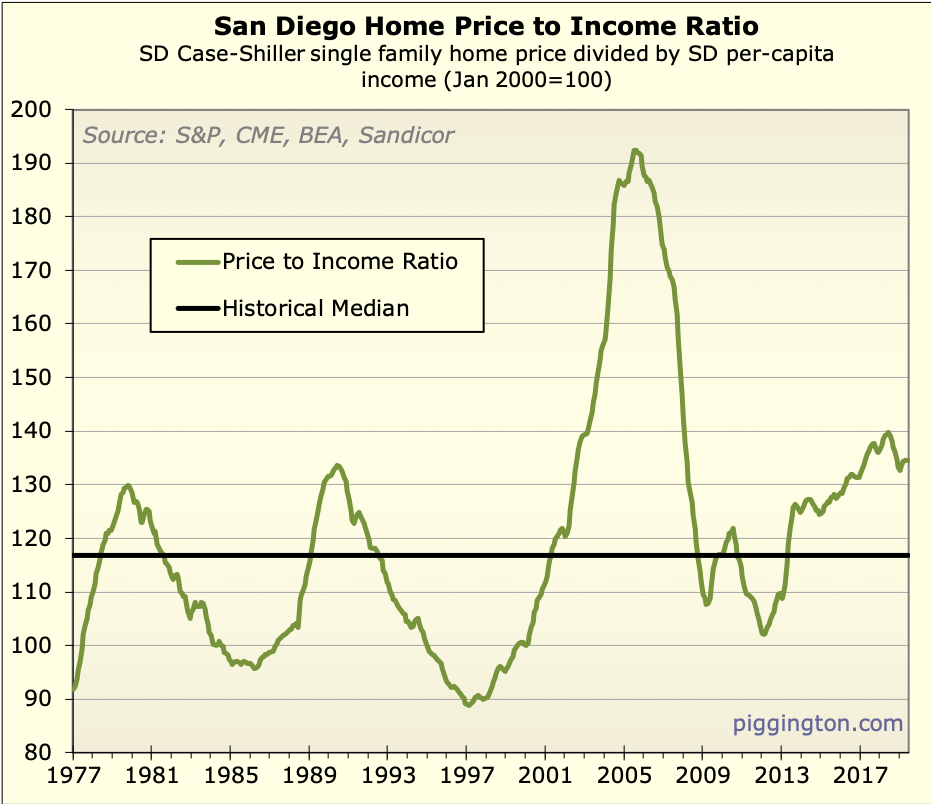

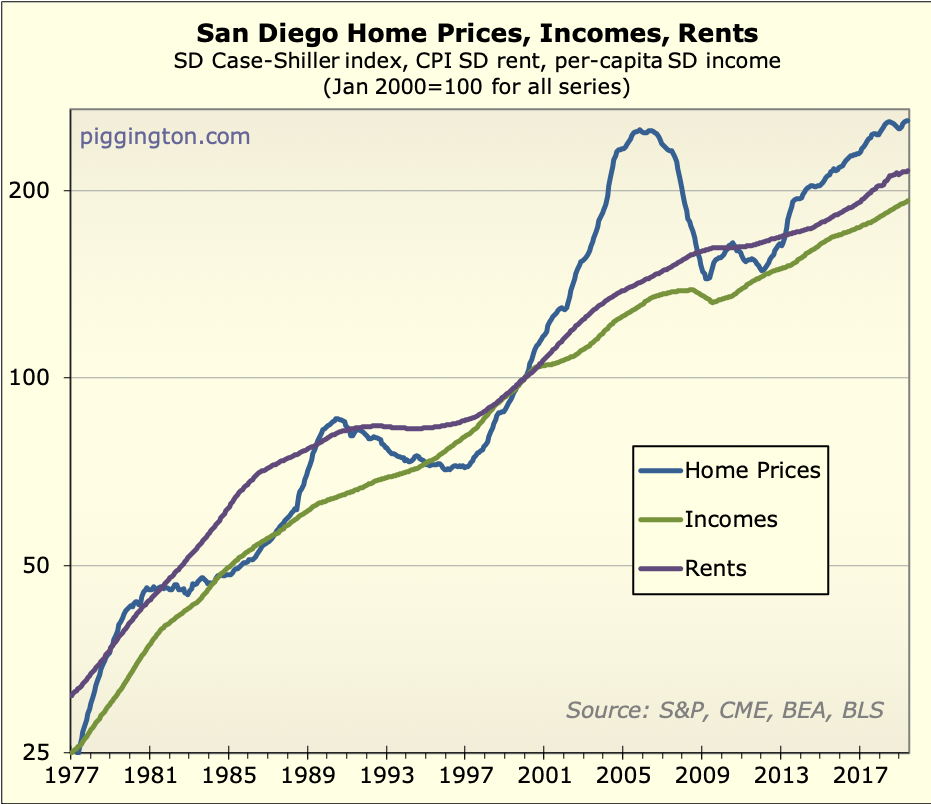

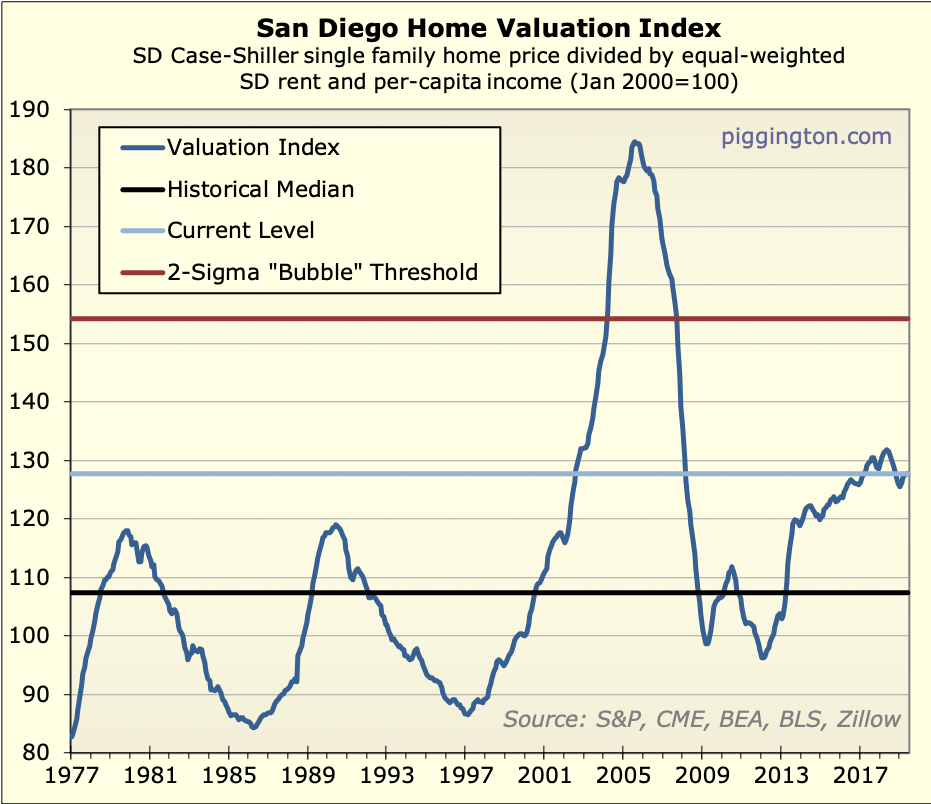

We all know that buying a home in San Diego costs a lot more than

in most cities. But that’s always been the case, and probably

always will be, because San Diego is such a desirable place to

live. More interesting is the question of how expensive San Diego

is compared to its own history. This can tell us whether prices

are out of whack even after adjusting for the desirability factor.

A good way to measure housing expensiveness is to compare home

prices to local rents and incomes. Rents tell us how much it costs

to live in San Diego as a non-owner, while incomes show how much

money San Diegans have to spend on housing.[1] By comparing home prices to

rents and incomes, we can get an idea of their cheapness or

expensiveness relative to the economic factors that typically

drive them. (This is also known as their “valuation”).

Here’s a chart of San Diego housing valuation since the late

1970s:

The main takeaway is that, while there have been significant

forays into expensiveness and cheapness, there has been a strong

tendency to revert to normal, reasonable (for San Diego)

valuations. This makes sense: if prices become unhinged from rents

and incomes, we should expect them to move back into line

eventually.

Valuations can be a big help in evaluating the housing market’s

potential risk and reward. And they are showing that today’s San

Diego housing market is quite expensive — not nearly at

bubble-peak levels, but more so than at any time outside the

bubble.

Can low interest rates (or something else) keep the game going?

Such high home prices are certainly a cause for caution. And yet,

there is an interesting twist this time around: interest rates are

unusually low, which has kept monthly payments reasonable despite

rising prices.

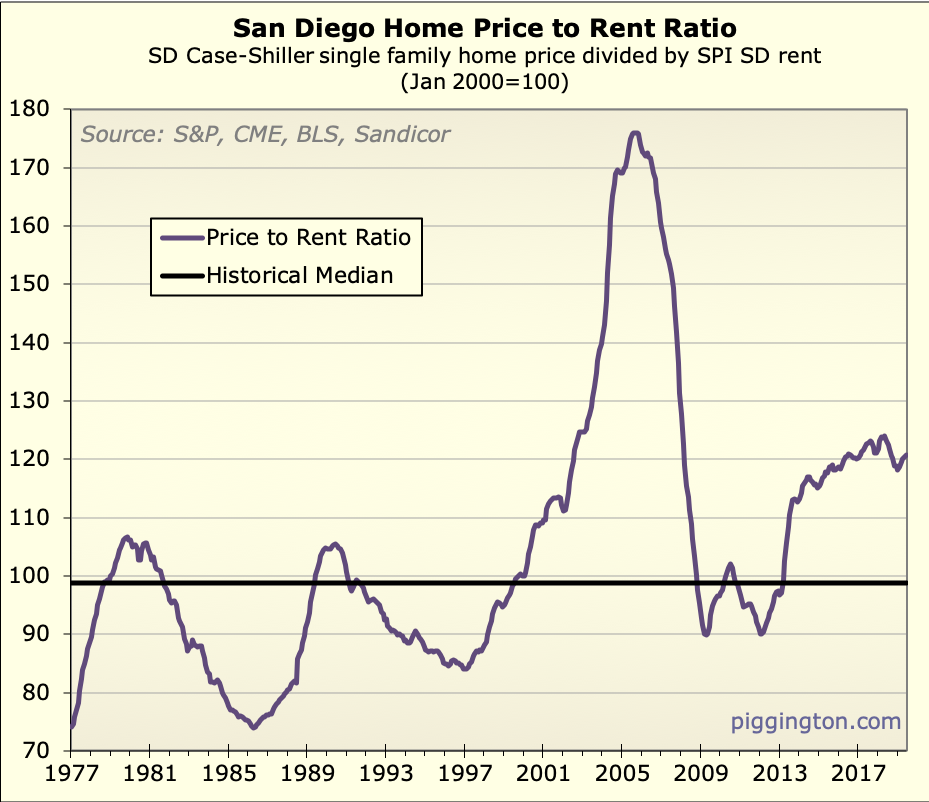

Here’s a chart that compares the typical San Diego monthly

payment to local rents and incomes. It paints a very different

picture than the chart above, which only considers home prices.

Thanks to low interest rates, monthly payments are actually more

affordable (compared to rents and incomes) than they typically

have been over the past several decades. Put another way: the

expensiveness of buying a home is more than offset by the

cheapness of the borrowed money.

Can low rates keep home valuations propped up at their currently

high levels? It’s possible, but there are a couple reasons to be

skeptical. The biggest one is that the idea depends on rates

staying unusually low. There is great debate as to whether that

will happen, and no one knows for sure. But in general, we think

that while unusual situations can persist, it’s not prudent to

depend on that happening.

Even if rates do remain this low, it’s questionable whether they

can keep home prices high forever. It turns out that, while low

rates may well play a part in today’s elevated valuations, they

have had very little influence on home prices in the past. (To

keep this letter from getting too long, we’ll leave it at that —

but if you’d like to read some evidence and theorizing about why

this is, please see this Voice of San Diego article Rich

wrote

a while back.) Again, it’s possible this has changed, but we

are wary of depending on it.

Other factors could influence valuations as well. For instance,

San Diego is an unusually housing-constrained city — while this

should show up in rents too, it could push prices up compared to

incomes. Changes to the number of out-of-town investors, to the

character of our housing supply, or to income inequality could

also exert pressure on the ratio of home prices to both rents and

incomes. Given that San Diego housing is, compared to global stock

and bond markets, a very small, illiquid, and supply-constrained

market, there is a higher possibility that it actually is

“different this time.”

It seems like such changes should be slow-moving and relatively

subtle, though. And in any case, they are speculative. The odds

have not historically favored the bet that it’s different this

time. The best approach is probably to allow for

the possibility that valuations have permanently shifted to some

degree, but not to depend on it.

Does it make sense to buy a home right now?

Summing it up so far:

- While San Diego housing

valuations have historically been all over the map, they’ve had

a strong tendency to eventually return towards the middle range

of their historical levels. - Currently, San Diego

housing is quite expensive compared to history (though well

short of bubble peak levels). - But unusually low rates

are keeping monthly payments at reasonable levels, and should

those low rates persist, it’s possible they could

prop up valuations indefinitely. - It’s also possible that

dueto unique economic factors, valuations could settle at a

different equilibrium level than they have historically. But

this would likely be subtle and somewhat risky to bank on.

So where does that leave a potential buyer? It depends on the

situation, and whether one is more concerned with future changes

in monthly payments or prices.

If one is buying a home to keep for the long haul, and financing

the purchase with a fixed mortgage, then the main priority is

probably to lock in a reasonable long-term monthly payment. In

this case, it may well make sense to buy. As the second chart

above shows, monthly payments are lower than the historical

average even despite high purchase prices.

If on the other hand a buyer isn’t planning to keep the property

for long, then it makes sense to be more concerned with what

prices will be when the time comes to sell. The first chart shows

the risks in that scenario. While it’s possible that valuations

could remain elevated, current price levels suggest more downside

than upside. However, this will become less of an issue as time

marches on and incomes and rents have a chance to catch up with

prices. (To put some very rough numbers on it: 5 years feels

risky; 10 years a lot less so).

Every situation is different, but the rough rule of thumb is:

- If monthly payments are

the primary concern, it may make sense to buy. - If future price changes

are the primary concern, it may be best to hold off until

valuations are a bit more reasonable.

The good news here is that there isn’t a lot of pressure to do

either one. There have been times where it was crazy to buy in San

Diego, and times where it was crazy not to. This is neither of

those times. Either choice is reasonable, depending on

circumstances, so you can do what best fits your own

circumstances and lifestyle.

The same applies to real estate owners. Given the context of low

rates, valuations aren’t high enough that anyone should feel

compelled to sell on that basis alone. But for owners who are

considering selling for other reasons (cash needs,

downsizing, moving out of state, selling a rental property, etc.),

they can sell now and take comfort that they are doing so at a

time of unusually high valuations.

1 – For more on the relationship between incomes, rents, and

home prices, see Rich’s Voice of San Diego article on measuring housing valuations. As discussed in

that article, the price/income and price/rent ratios have been

very similar throughout history, so we’ve combined them here for

simplicity.)

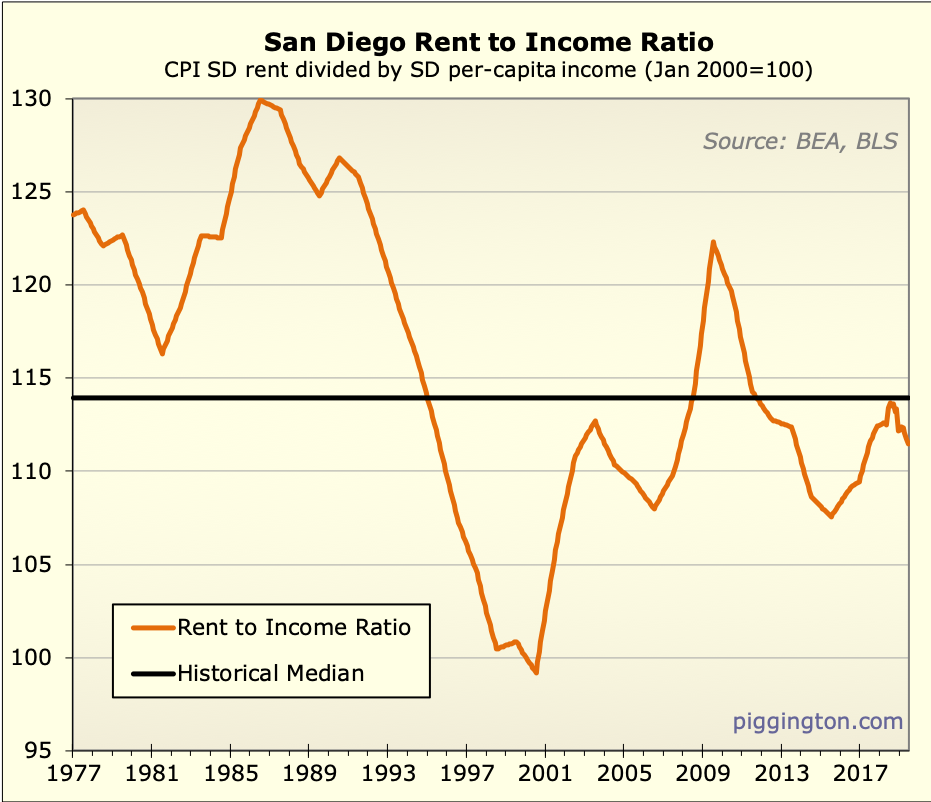

A few more graphs:

Some rate headlines from

Some rate headlines from today:

US 30 year 0.05% away from multi-decade low

Irish 10 under 0% for the first time

German 30 year headed for 0, now record low of 0.12%

Spanish 30 year under 1% for first time

Dutch 10 year under -.5% for the first time

Pimco warns US rates could go negative

I appreciate all the charts!

The payment index is the most significant IMO and shows the thing buyers care about most is near all time lows, and could actually be breaking them today if the 2019 figure is using 2019 average rates.

A drop in rates doesn’t mean

A drop in rates doesn’t mean a commensurate drop in payments. 3.75% to 4.5% rate is a 20% delta, but only changes the monthly 30y payment by about 9% (from $463 to $507/mo per $100,000 loan). Plus, recession = lower incomes. That magic 43% DTI for qualified mortgages suddenly starts being an issue.

Bonus points if we go into recession and we end up with a blue White House and Congress. Cuts to the defense industry, here we come, WHHHOOOOO-WHEEEEEEE! More social programs, fewer ships, less recruitment…

Think what happened to certain parts of LA and Long Beach in the early 1990s when the aircraft industry started closing down and cutting back due to the Cold War being over.

SPD, at 0% a 30 year mortgage

SPD, at 0% a 30 year mortgage is still $278 a month per 100k.

The payment decrease from Oct 2018 to today on a common 650k loan is about 600/mo.

To put it another way, the “buying power” of someone willing to pay 3k a month has gone from $539k to 650k, a 20.5% increase.

In terms of psychology and momentum, all the bulls from the past 5-10 years who will be doing refis will suddenly see their already profitable investments become more so as they cut their monthly payments.

Are you opposed to riding the next bubble up on principle? I am a bear at heart, I am net short US equities. But I have shorted enough bubbles the past 15 years to know that another RE bubble is a-brewin’. The last piece to fall into place will be lending standards getting thrown out the window. And the current ultra-low default and delinquency rates on subprime mortgages is how this starts.

The period where the 30y was

The period where the 30y was above 4.5% was only 2-3 months, which is why I’m calling it a decrease from 4.5% to 3.75%. The delta from 4.5% to 3.75% is more like $286/mo. ($507-$463) * 6.5 = $286

I’m opposed to a bubble because I want to buy and hold for life, not ride a bubble and worry about when to sell. Buying cheap and collecting staid, boring, monthly rents and being able to kick back and chill off is much more appealing than constantly churning investments (aka work). I’m a boring, retiring personality that way. The more I can just coast my way through life, the better — I don’t have the kind of creativity or drive to be “active.”

My goal is safety and comfort without being dependent on day-to-day employment, not extreme wealth. Basically, build my own welfare/disability/”guaranteed mincome” program, collect about $50k (inflation adjusted for life) which is enough for an efficiency apartment, a used motorcycle, food if I cook on my own, health insurance, and the occasional trip every year. Beyond that, I don’t actually have any goals, desires, or feelings of purpose other than to roll through life without being bothered or bothering anyone too much.

SPD, I am using the 10 year

SPD, I am using the 10 year treasury rate, which best tracks 30 year mortgages.

It is down from 3.2 in 10/2018 to 1.7% now.

So if a mortgage is now 3.75 (sounds right) it was more like 5.25% back at its fall 2018 recent peak.

spdrun wrote:

My goal is

[quote=spdrun]

My goal is safety and comfort without being dependent on day-to-day employment, not extreme wealth. Basically, build my own welfare/disability/”guaranteed mincome” program, collect about $50k (inflation adjusted for life) which is enough for an efficiency apartment, a used motorcycle, food if I cook on my own, health insurance, and the occasional trip every year. Beyond that, I don’t actually have any goals, desires, or feelings of purpose other than to roll through life without being bothered or bothering anyone too much.[/quote]

Calvin Coolidge was on to something when he observed in 1925 that “the chief business of the American people is business,” adding: “They are profoundly concerned with producing, buying, selling, investing and prospering in the world.”

^^^

I’m not. I’m just happy

^^^

I’m not. I’m just happy to exist without being bothered or bothering anyone too much. I Am a Rock.

gzz wrote:But I have shorted

[quote=gzz]But I have shorted enough bubbles the past 15 years to know that another RE bubble is a-brewin’.[/quote]

I just don’t see it. When you have an epic, economy-ruining bubble in one asset class, you don’t get another bubble in that same asset class. An entire generation of buyers has had the “real estate only goes up” BS beaten out of them. I don’t think we’ll see another RE bubble for a long time.

Purchase valuations are very high for sure, but that’s really not euphoria or a bubble, it’s a response to very low interest rates. I don’t think it’s a bubble now and I will be very surprised if it becomes one.

(Although as a homeowner, I’d be quite happy to be proven wrong!)

Chinese buyers in 2015 not

Chinese buyers in 2015 not only got the normal appreciation local us homeowners enjoyed, but also a 13% additional return due to the rising dollar.

Mexican and British 2015 buyers got an extra 25% return.

Canada buyers, an extra 5%

US is seen as less friendly

US is seen as less friendly to foreign buyers these days and perception matters … the right is a bunch of xenophobic shits; the left is talking about rent control and taxing the hell out of absentee owners… Plus the Chinese themselves are taking measures to prevent capital flight.

A rising tide lifts all boats. The beauty of anti-globalism and anti-capitalist rhetoric is that it turns the ocean into more of a lake, incapable of lifting nearly as much.

What’s that Chinese proverb

What’s that Chinese proverb about living in interesting times?

Thanks for the charts, Rich. Awesome work as always.

Yet another 35-month low on

Yet another 35-month low on the 10 year, and UBS predicts 1.25% by year end, an all time low that will drive mortgage rates to about 3.0%. 30 year is nearly at an all time low, could break it tomorrow, then look out below.

Spain and Portugal are about to join the negative rate club, they are now at 0.23 and 0.25.

Spanish short bonds are already in negative rate land, -.5 for 1 year and -.25 for 5 year.

Money’s rotating from stocks

Money’s rotating from stocks into bonds… whose 401ks just took a bath in iced piss won’t be so eager to buy homes…

spdrun wrote:Money’s rotating

[quote=spdrun]Money’s rotating from stocks into bonds… whose 401ks just took a bath in iced piss won’t be so eager to buy homes…[/quote]

People will need to rent. So investors will make money renting out their properties. Which will cause investors to buy in search of yield.

In many parts of the country you can still buy apartments below replacement cost. How much do you think replacement is for basic apartments? $150/Sf?

This is what “the Google” found.

https://www.proest.com/apartment-building-construction-cost-breakdown/

Um, you can buy most things

Um, you can buy most things below “new replacement cost.”

It varies a lot by

It varies a lot by area.

Encinitas and other coastal are way above last bubble prices.

wcvarones wrote:It varies a

[quote=wcvarones]It varies a lot by area.

Encinitas and other coastal are way above last bubble prices.[/quote]

True, that’s a weakness of these aggregate stats for sure. But I do think there is some value in looking at things as a whole. (Breaking it down by area would be very useful too, but I think putting together that data would be very difficult).

To make a somewhat pedantic point, though – everywhere is now higher than bubble peak prices, in nominal terms. (Or at least, the average is). But nominal prices are not meaningful at all; what matters is how much prices have changed vs. rents and incomes.

On that measure they are nowhere near the peak, on average. And I very highly doubt that they are anywhere near the peak in any location, including prime coastal areas.

However, it is definitely true that those areas have held up way better and have higher valuations than the averages I have charted above.