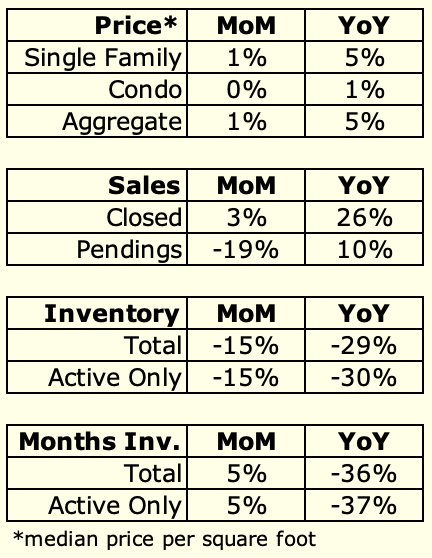

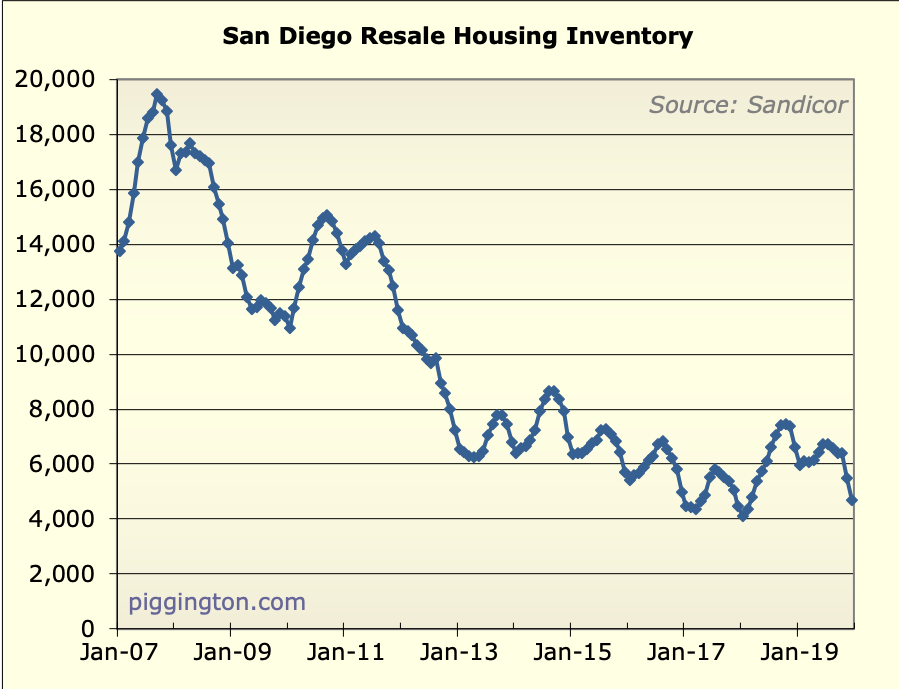

Well, here’s how the stats looked for the year:

Quite a change from December 2019, notably with months of inventory

down 36%. It’s no coincidence this took place alongside a steep drop

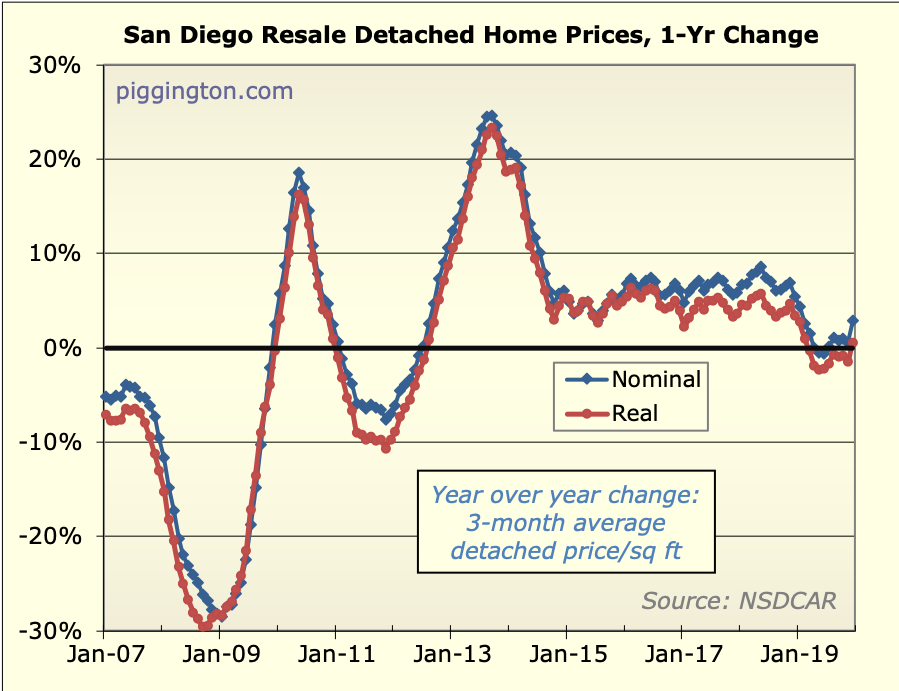

in interest rates. I think the behavior of the past 2 years — the

rapid slowdown when rates rose, followed by a rebound when

rates fell again — makes it pretty clear that the housing market is

very much beholden to continued low rates.

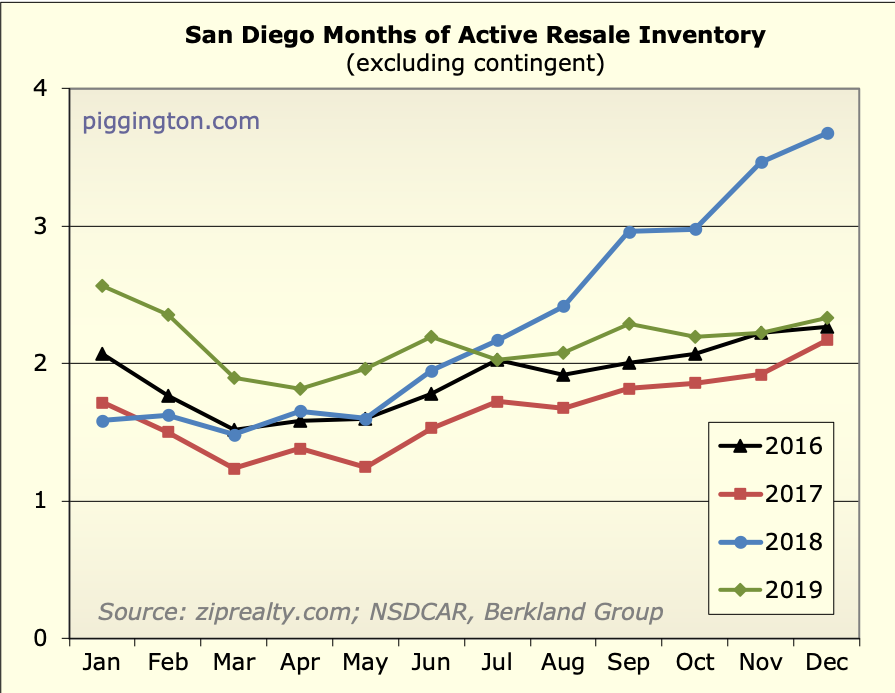

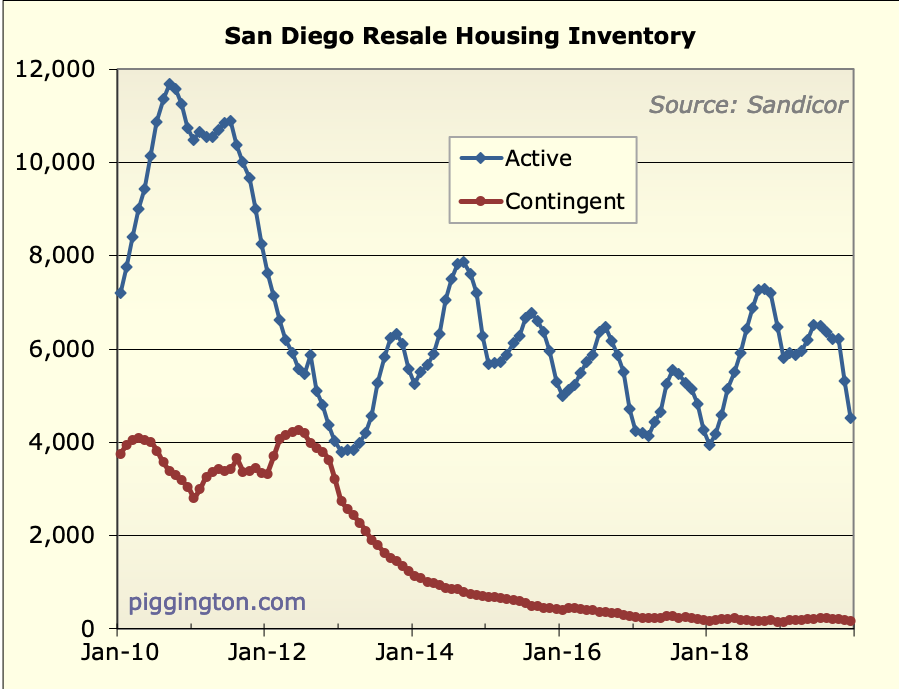

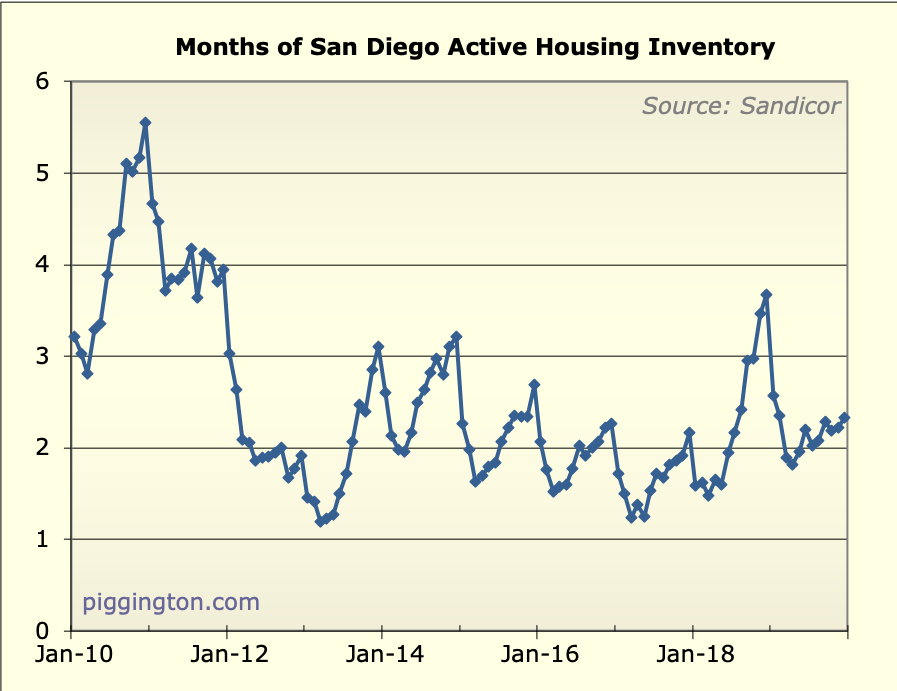

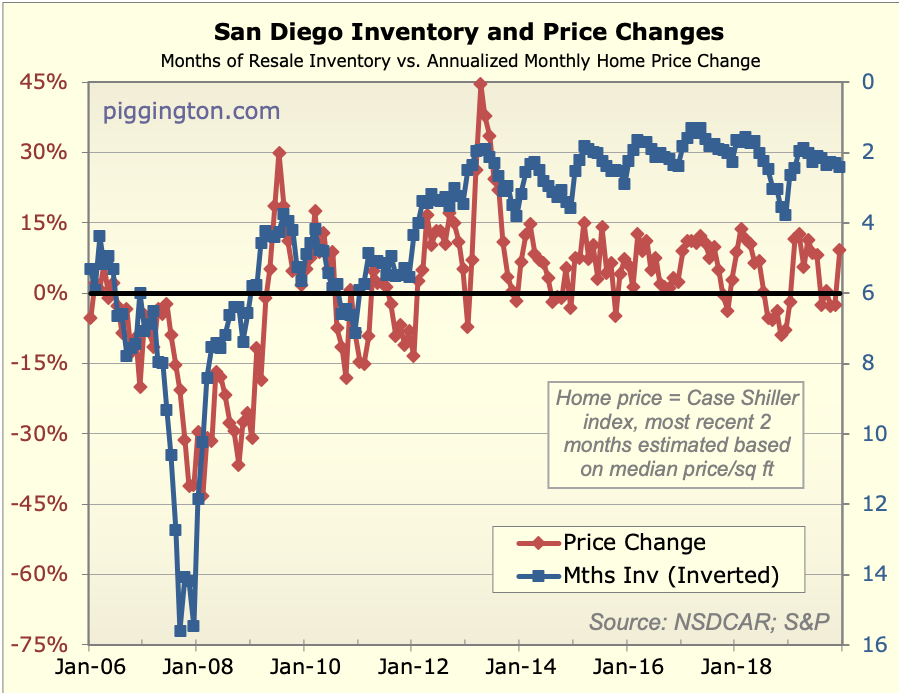

Here is what I believe to be the best indicator of short term market

strength — months of inventory (number of homes for sale divided by

the number of pending sales in a given month).

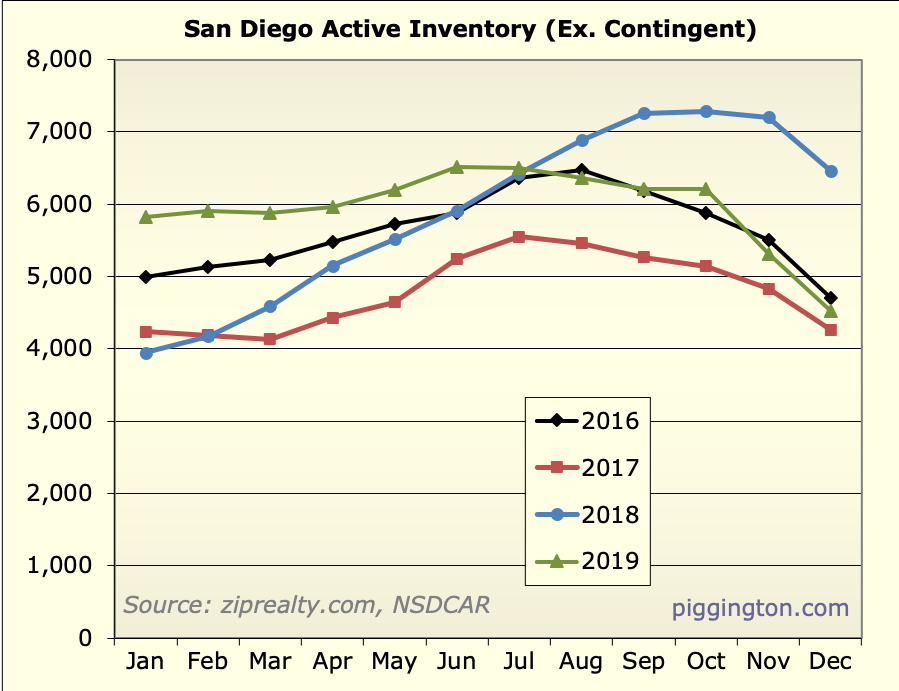

You can see the serious weakness that took place in 2018, as

mortgage rates rose to nearly 5%. Once rates dropped back down to

the 4%-and-below level, months of inventory dropped to its typical

(in recent years) levels.

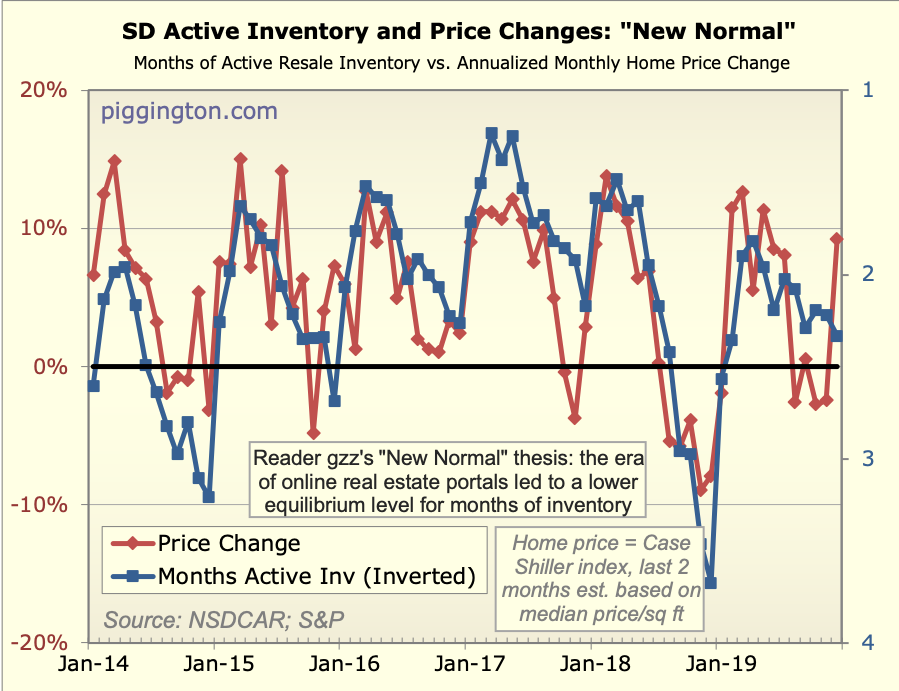

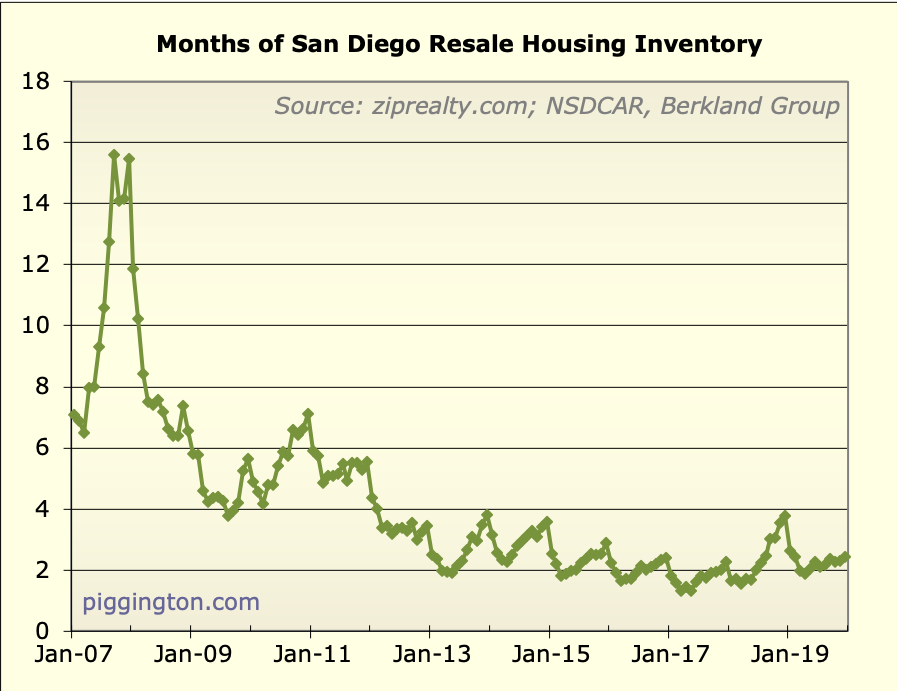

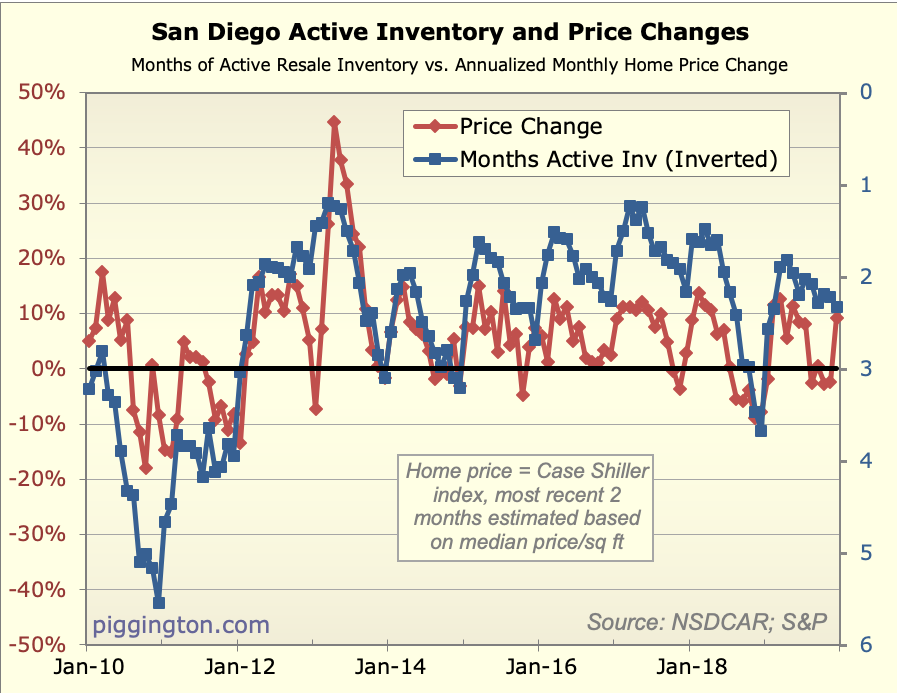

The next chart shows that months of inventory (inverted on the

chart) generally coincides quite well with monthly price changes.

Current supply/demand levels are supportive of further price

increases in the near term. But the charts above should serve as a

cautionary tale… should rates abruptly increase as they did in

2018, the dynamics of the housing market could change just as fast.

More charts below…

Thanks, Rich!

Thanks, Rich!

When I consider alternatives

When I consider alternatives for money these days:

1. buy stocks paying 2%

2. buy bonds paying 1.7% on ten year

3. pay down debt at 3.1%

4. buy real estate with rental yields of 6%,

It seems like real estate could win.

My normal instinct would be for caution but I’m not seeing much on the horizon which may really shift the overall economic environment.

I would expect real estate to appreciate by at least 1% per year going forward.

Haven’t posted in a while, any thoughts are appreciated.

Treasuries are an awful long

Treasuries are an awful long term investment. The market is dominated by central banks (Ours and foreign both) that buy for reasons nothing to do with their actual value.

I like the taxable muni fund GBAB. Monthly payments and about 5.5% taxable yield right now. That has long been my low risk liquidity investment.

Stocks and local RE I think are both good investments. I like local RE more though. Better tax treatment. Also, anyone can buy US stocks, but we personally have advantages that allow us to do higher yielding landlording.

Paying back RE debt at 3.1% fixed? I wouldn’t.

So last weekend I made a bid

So last weekend I made a bid on a 4BR house in 4S, 2100 sf.

Buyer accepted the offer and now they have to find a home.

They made a bid on a home which wasn’t accepted so now the sale is at risk of failing if they don’t find another home in 12 days (17 total) from signing of contract.

Has anyone been in this situation? How did things work out?

We can mutually extend the time they have to find a house too but my potential renter is coming in early April so I don’t have a large time window.

Thoughts?

I would offer a rent back.

I would offer a rent back. Doesn’t help your renter situation, but you get the house.

Rich,

I’m curious to hear

Rich,

I’m curious to hear your thoughts on the economic implications of the Covid-19 coronavirus, which is likely to reach Pandemic status soon. Our reliance (in pretty much every industry) on China are staggering, and I’m curious to know your perspective on the potential implications for our real estate values here in America’s Finest City.

Thanks,

Andrew

Hi Andrew – I’m afraid I

Hi Andrew – I’m afraid I don’t have any special insight into that. In the short term, who knows. It’s possible it could tip the economy into recession and bust up some supply chains.

But long term I don’t see why it would have an impact. There will be a vaccine eventually so the effects will not persist forever. A recession was going to happen at some point anyway; having moved it forward doesn’t really change things in the big picture. Supply chains will adapt, as they do (and as they already have been doing due to the trade wars).

That’s my take. Summary:

short term – unknowable

long term – irrelevant

Rich

Rich,

How about an updated

Rich,

How about an updated post? Many (most?) of us are stuck at home with time on our hands.

Thanks!

I only have thru Feb, not

I only have thru Feb, not very interesting at this point. I will post once I get March.

Sounds good. Thanks! I’m

Sounds good. Thanks! I’m reading anything and everything right now. But I especially like your posts.

Thank you!

Thank you!

Been a long time Rich. We

Been a long time Rich. We have to catch up on the market. Its been an interesting 10 years. Lots to catch up on. Will try to share an update with everyone as we enter interesting times again once it becomes clearer

Hey, welcome back sdr! I look

Hey, welcome back sdr! I look forward to hearing some more status updates from the trenches…

So Ive been checking in with

So Ive been checking in with Rich once or twice a year with observations since leaving the asylum several years ago. There is lots of interesting things to talk about again and the long and short of it is for the first time in about 15 years I dont believe I know what will happen. I have pretty strong guesses but with so much uncertainty its hard to commit to anything yet.

I figured Id share the message I sent Rich about a week ago. Since I sent that message RE has been declared an essential service with restrictions that still impair conducting business significantly. It has opened things up modestly but the mechanics of the market are still pretty locked down for now.

Been a long time since I checked in. Hope all is well at home, work and on the blog. Sitting home drinking wine most of the day watching the financial markets and thought of you. Figured Id give you an update from the streets.

RE is in a real interesting spot right now. Even with all the negative news and plunging stock markets houses were selling left and right around my hometown and beyond. It was hard to believe but homes over $1M were exceptionally strong until the shelter in place order came last Thursday. There were 2 or 3 houses above a million going into pending status nearly every day. I am constantly shocked by the strength of our market. Rightly or wrongly people are driven to buy homes around here even in the face of unbelievable negativity.

Then it came to a grinding halt on Friday when a clarification came down from CAR that real estate was non-essential and we were to immediately stop all face to face interactions including appointments with clients, open houses and showing homes. At that point it became next to impossible to buy or sell a home. There were a few stragglers that went pending as negotiations may have been in process and there are a small group flouting the rules but its pretty much locked down in real estate. To put this into perspective since Saturday exactly 1 detached home has gone pending in the entire City of Carlsbad. It was a very desirable 1 story listed prior to the lock down which probably took a few days to work through multiple offers. How they will get it closed is beyond me until restrictions get relaxed.

On cancellations I counted 40 in the City of Carlsbad last week. If I had to guess Id say its been as high as a 1/3 of those that went pending in the prior 2 weeks. They are usually negligible but the uncertainty has sent a significant portion of buyers back onto the sidelines until they get some clarity. That and there is no clear path for them to close as there are questions whether inspections are allowed either. I have one such set of buyers who are in escrow on a listing of mine. They want to buy it but need more clarity with the economy to proceed. It makes no sense for us to go back on market as we cant show it so we are just holding with them for the time being. Its is extraordinarily strange times.

On the loan side, I am hearing things are just fine. The refinance market is rip roaring. Its all done online and not impacted much. If anything they have far more business than they are capable of processing at the moment so most raised rates to slow down demand for now. Im recommending friends and family to hold off a month or two. Long term rates are going to stay low and mortgages are artificially inflated at the moment. Once they get through the current tranche they will lower again closer to 3 to refill their pipelines.

Homes that were in escrow and within a week or two of closing should have no major obstacle to close. I had one close last week. Going forward closings will dry up to a trickle in another 2 weeks.

For your tracking closings should be down quite a bit in March. In April they should be stunningly low. BUt here is the interesting part. It will mean little to nothing regarding the current or long term health of the market. I know people will want to make more of the data then is really there. There are artificial impediments making sales nearly forbidden. There is massive demand out there waiting to buy not only whats on the market but whatever comes on the market that is fairly priced. I think we could see a slight hiccup in prices but anything real would take 6 months to a year to truly show itself. Of course all bets are off if this pandemic turns into a real sh*t show and persists for more than 2 or 3 months. Even then this market is so resilient and has always come roaring back countering the its different this time argument. Barring something cataclysmic Im anticipating we should be fine. There will be lots of noise in the data that wont truly be representative of market sentiment. Long time bears will start crowing but will get silenced shortly thereafter.

For now we all sit, watch and wait and drink wine.

Cheers!

outamojo asked if I see a meltdown coming in residential and I dont. He asked about commercial also and not only is that outside my expertise but its a much more diverse target. Shopping malls, casinos, hotels should get pummeled. Healthcare and cold chain shipping facilities should see boom times. It really depends upon the sub-market in commercial.

Im happy to address any questions but may be slow on the response. Apologies in advance.

I’ll add on bit of data along

I’ll add on bit of data along the NCC. Its the approximate ratio of activity for the last 7 days

4 new listings : 2 price reductions : 2 pendings : 1 back on market : 3 closing

Looks like not much interest

Looks like not much interest here in talking about anything other than corona virus but here’s an update on the stats

4 new listings : 2.5 price reductions : 2.5 pendings : 1.5 back on market : 3.5 closing

Any changes to the ratio are likely due to me being more specific in my math. Generally speaking a slight uptick in new listings, price reductions, new pendings, cancellations and closings. Activity is trending back up after grinding to halt. It doesnt feel like there is any real shift. Mostly it feels as though with real estate now an essential service again albeit with restrictions people are slowly figuring out how to get business done again.

So our sellers made at least

So our sellers made at least 5 offers but none were successful, there are often competing aginst 10-11 other offers.

We’re about to bid on another house, as it is too difficult to buy from a contingent seller in this market.

Well, turns out that in a

Well, turns out that in a pandemic:

Cash is king

Then govt bonds

Also you never lose money paying of debt.

Still stocks being now 17% off vs about 30% at the low point, clearly much more volatility than real estate at least in short term.

So 5 years from now: stocks are flat/30% higher/50% higher, some other value?

and real estate: down 5-10%/flat:10% higher/20% higher

Still for the moment happy that I’m 65% in real estate. Don’t really see it dropping that much over next 5 years.

Another interesting

Another interesting observation from the field. I just reviewed closings in the area I track along the coast. There were 24 the last 3 days. Out of the 24, there were 11 that closed above asking price which means multiple offers on the property. Just an amazing figure which says to me that if you have a nice home, priced at fair market value there is plenty of demand as long as you have access for buyers to see it.The strength of this market never ceases to amaze me

Another update for last 7

Another update for last 7 days. Market is plodding along and not seeing any big changes.

Ratio is still holding

4 new listings : 2 pendings : 1 back on market : 4 sold : 3 price reductions

Less homes seem to be falling out of escrow as buyers get more comfortable with the situation.Still at least 1/3rd of closings at or above asking price so multiple offers on those. Perhaps a few more price reductions as time goes on and some sellers seem to be taking a nice discount to asking but far more the exception than rule.

Thanks for the updates SDR, I

Thanks for the updates SDR, I also look forward to Rich’s next data post.

I only follow 92107 closely, but everything appears normal to me. You’d think a deep recession would be bad for RE, but in the past that often hasn’t been the case due to rate cuts and flight to safety.

There’s no doubt that a long-term effect of CV will be that working from home becomes more popular. You absolutely need more space in your home to do this.

I would agree with the caveat

I would agree with the caveat that time will tell. For now even in a very restricted market things are selling at or near recent pricing. The longer this goes the more that could change

Just to clarify, my stats are tracking things over time so we can see when and if an inflection point occurs.

Too soon! Real estate doesn’t

Too soon! Real estate doesn’t seem to move at human speed. Any actual drop in pricing is months away, if not years. Most of us have lived through a bubble so immense we are waiting for almost biblical justice, but that almost never happens. On the other hand 50 million people just lost their jobs. That is going to leave a mark.

Josh

You’d think so, but…

You’d think so, but…

SDR, any news? I mean about

SDR, any news? I mean about wine, not RE.

Josh

LOL, just saw this Josh. Wine

LOL, just saw this Josh. Wine is great and looking forward to arrival of 16 Barolo. Consumption defntely trending up just like home prices. As much as you are prone to negativity the bullet around here has been been dodged. If something happens it will take a lot longer longer and will be due to many other factors than what we are looking at now. Enjoy the vino, dont sweat the RE

And im sdr not SDR. I wonder what happened to the other guy who stole my user name. Think he’s licking his wounds somewhere in Texas or elsewhere just like ur guy is in SD 🙂