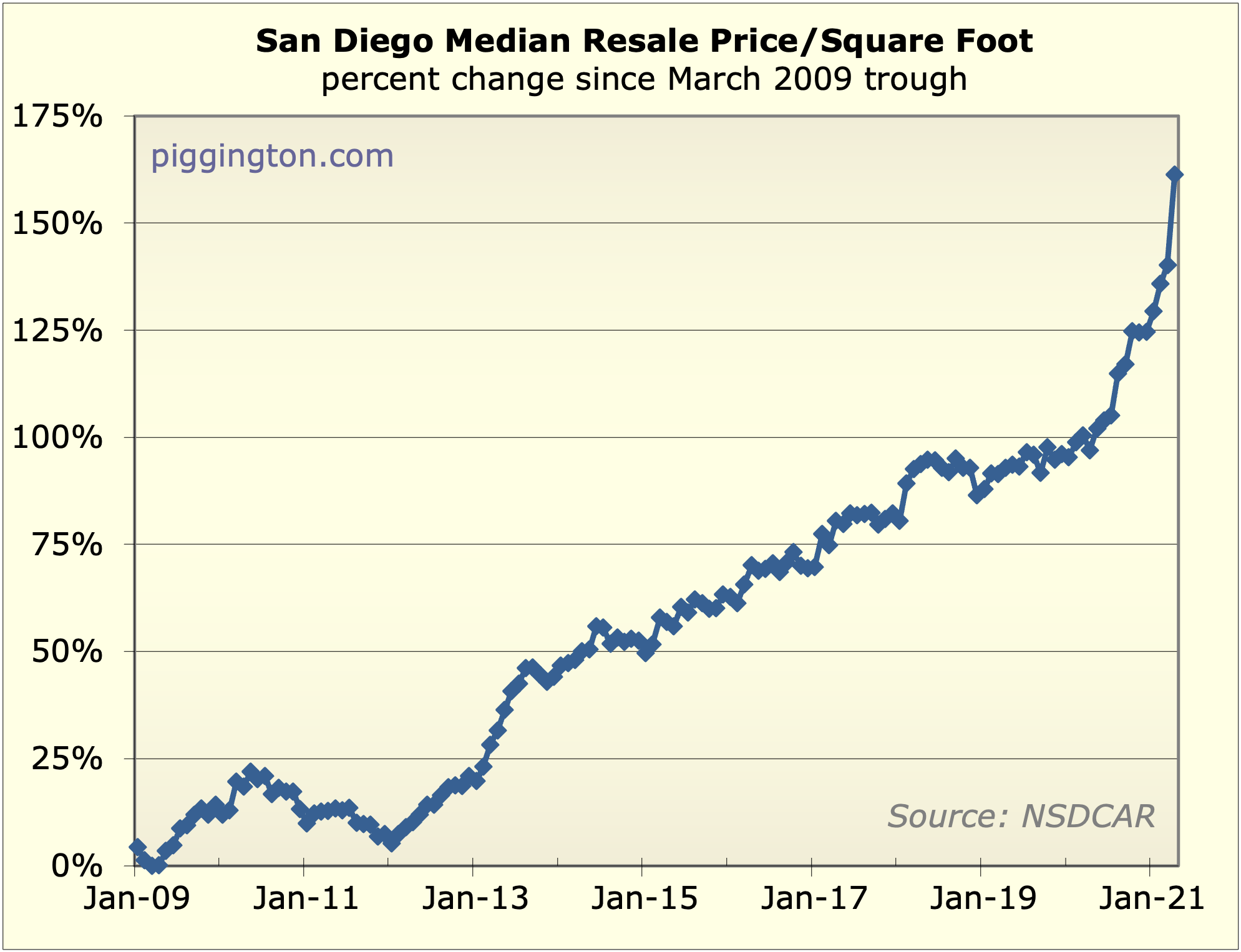

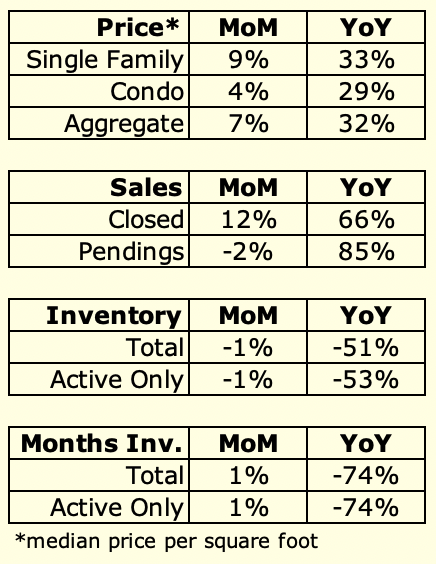

I’m just going to start with this:

OK, the price per square foot is a somewhat noisy figure. You can’t

make too much of just one month. With that said… holy mackerel.

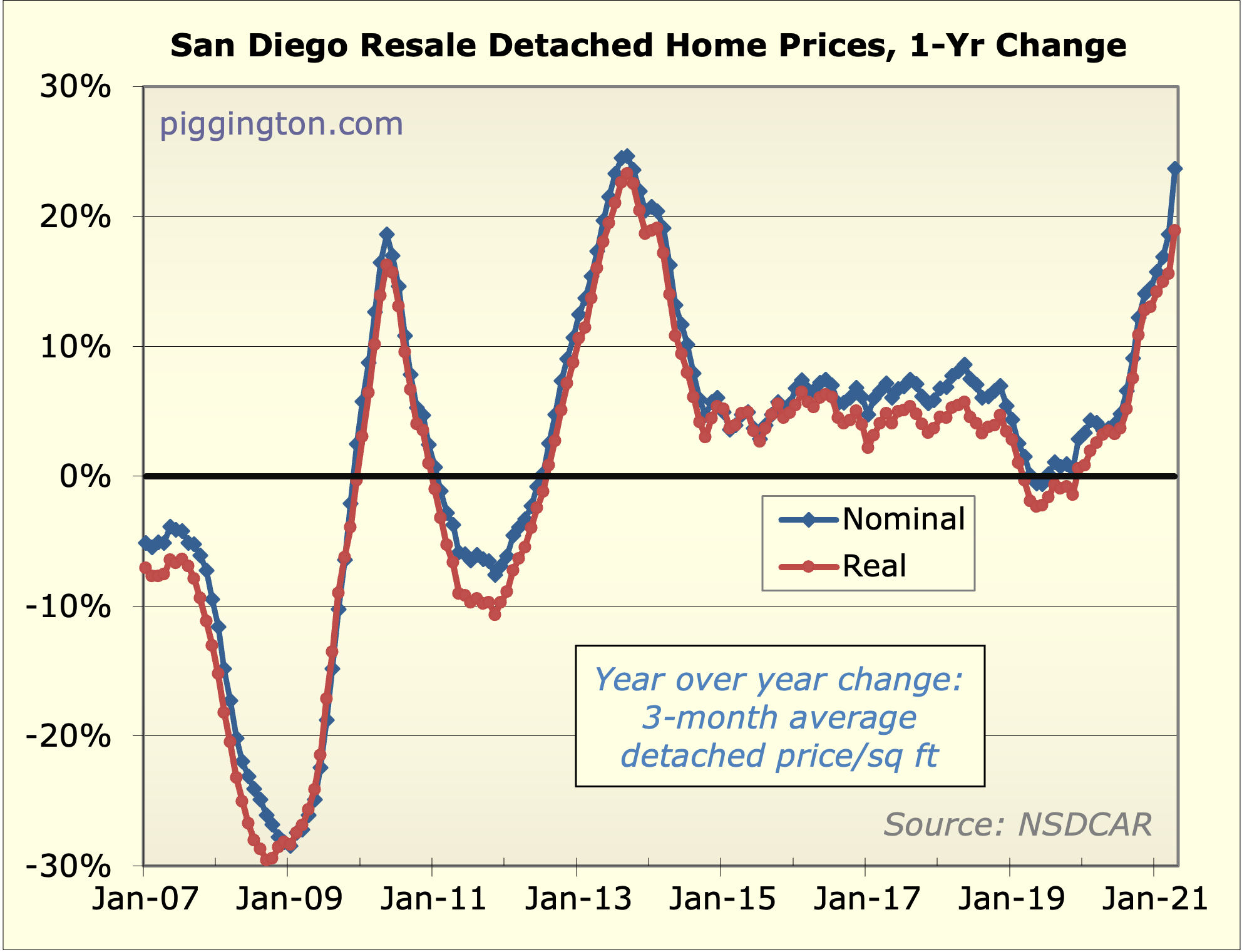

The single family price/sq ft was up 9% in a single month.

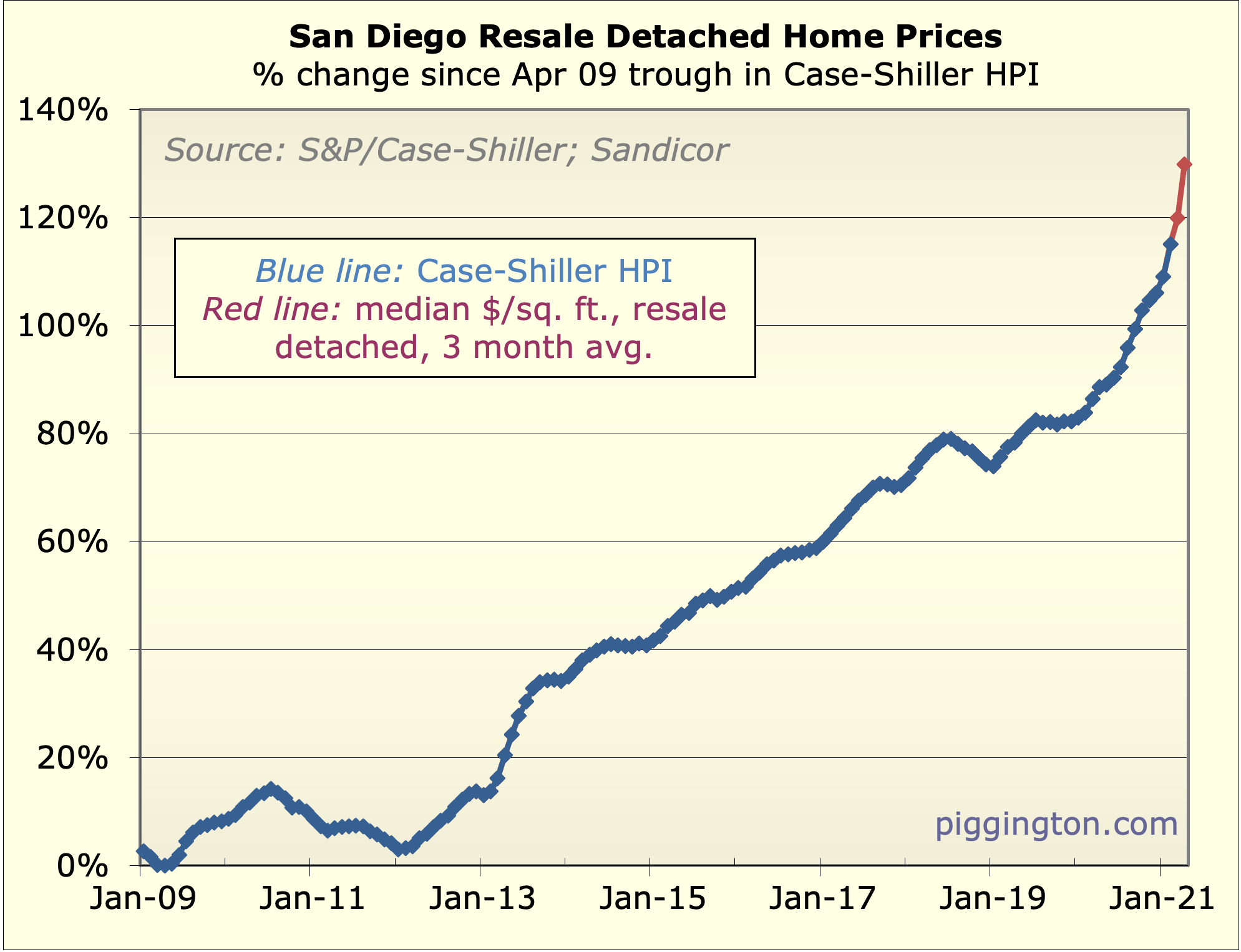

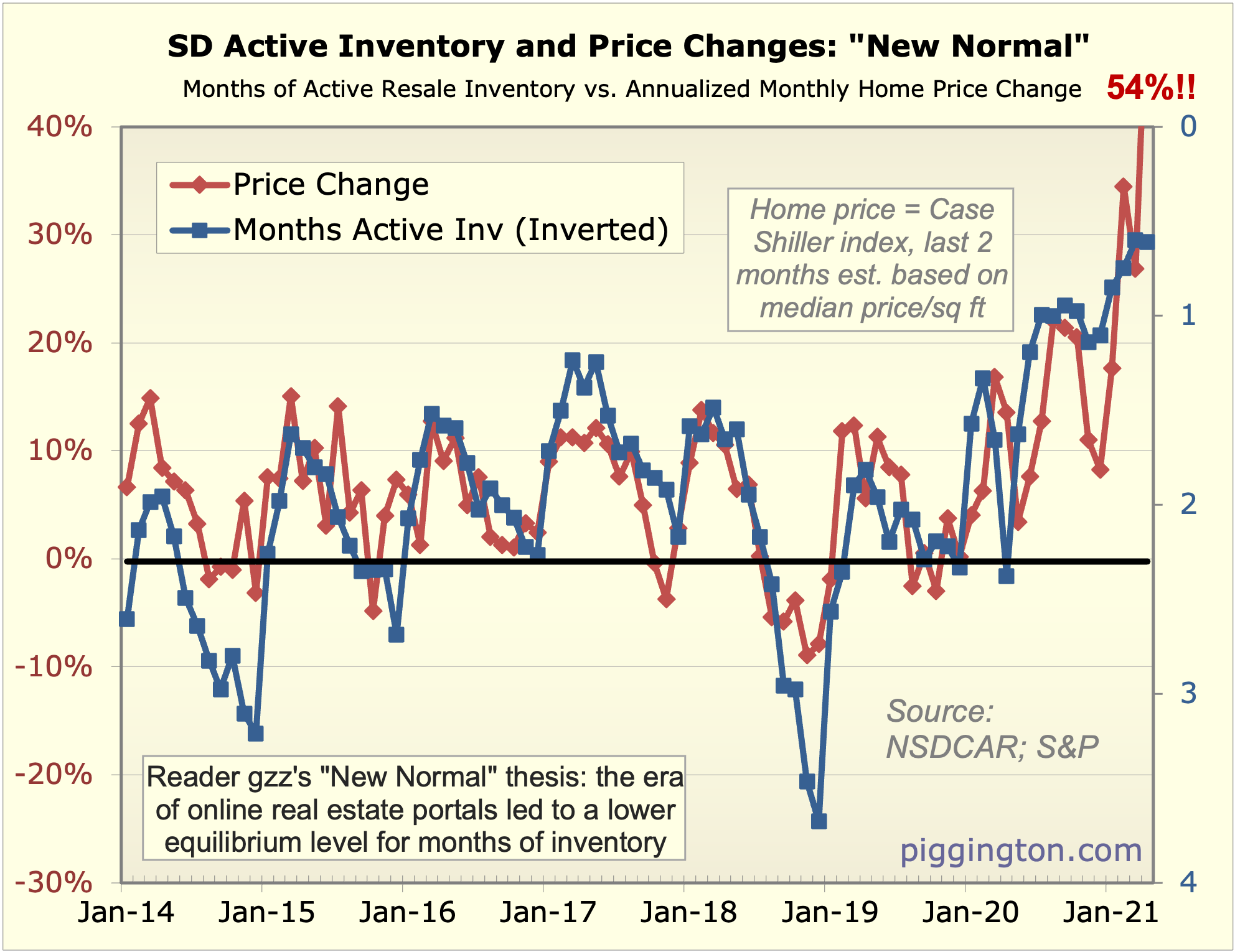

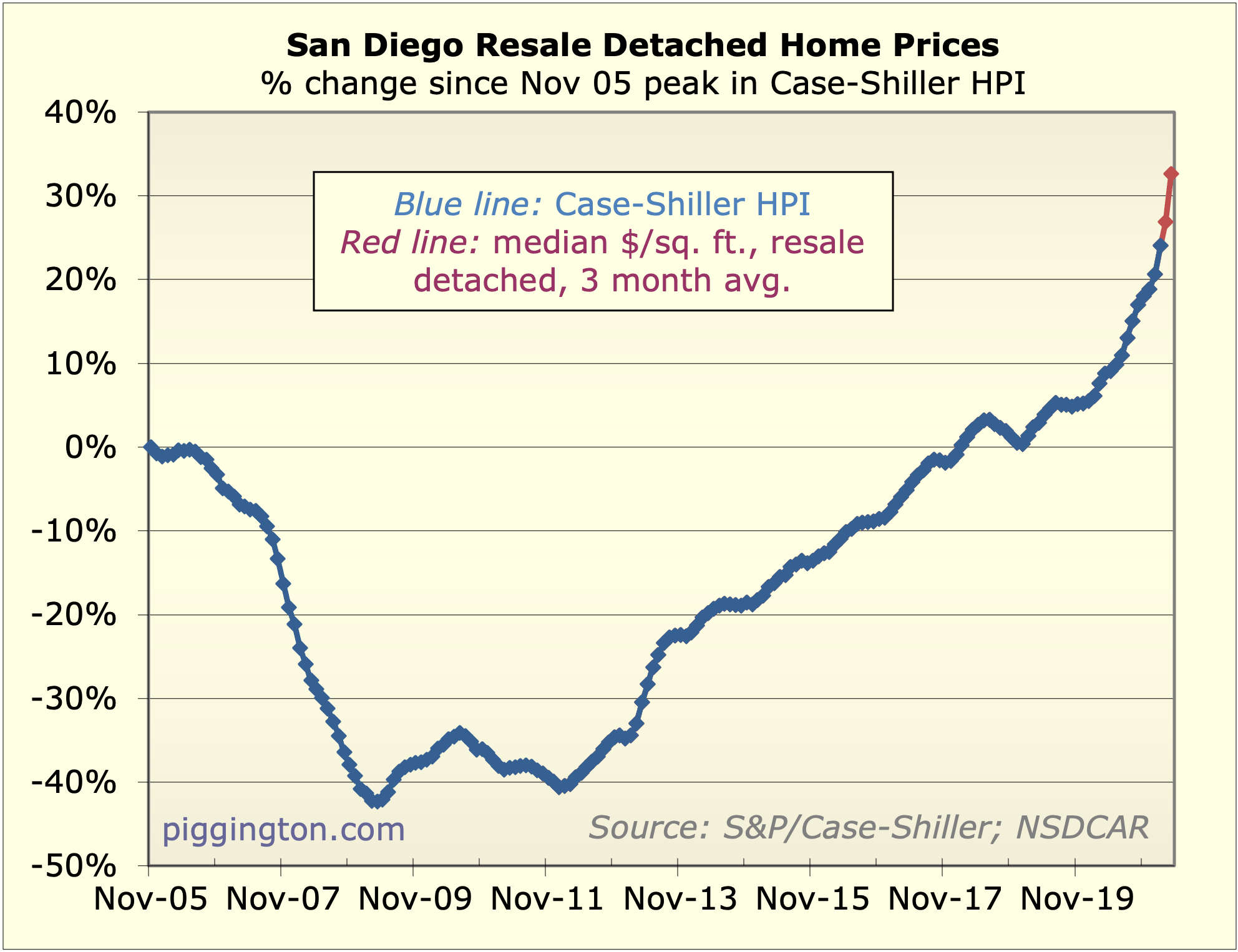

The blue line below shows the much-less-noisy Case-Shiller index.

The red is my estimate of the past two months, which is based on the

ppsf and thus re-introduces some noise, but here it is for what it’s

worth:

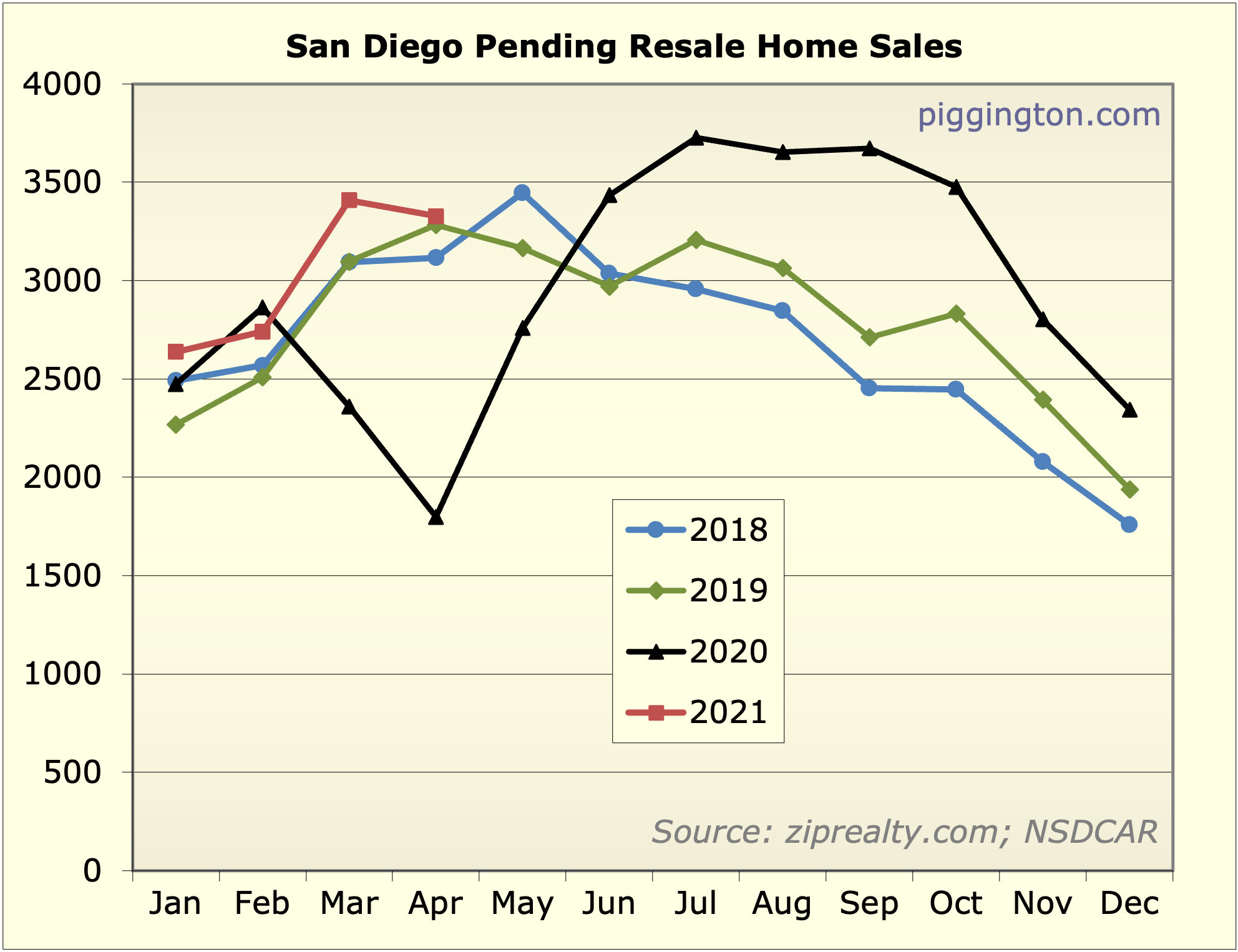

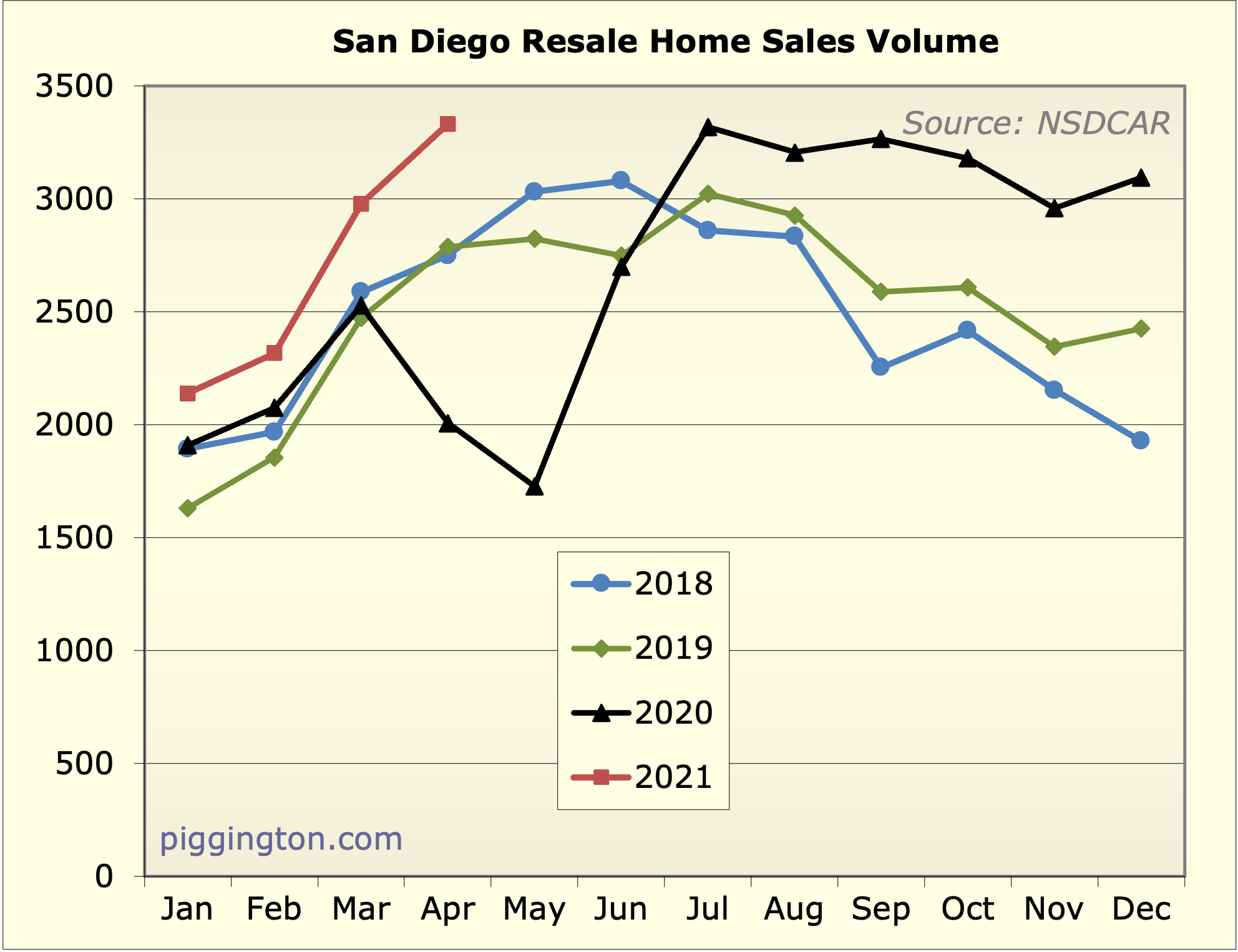

The story here is much less of demand than of supply. Demand is

strong, but nothing out of the ordinary:

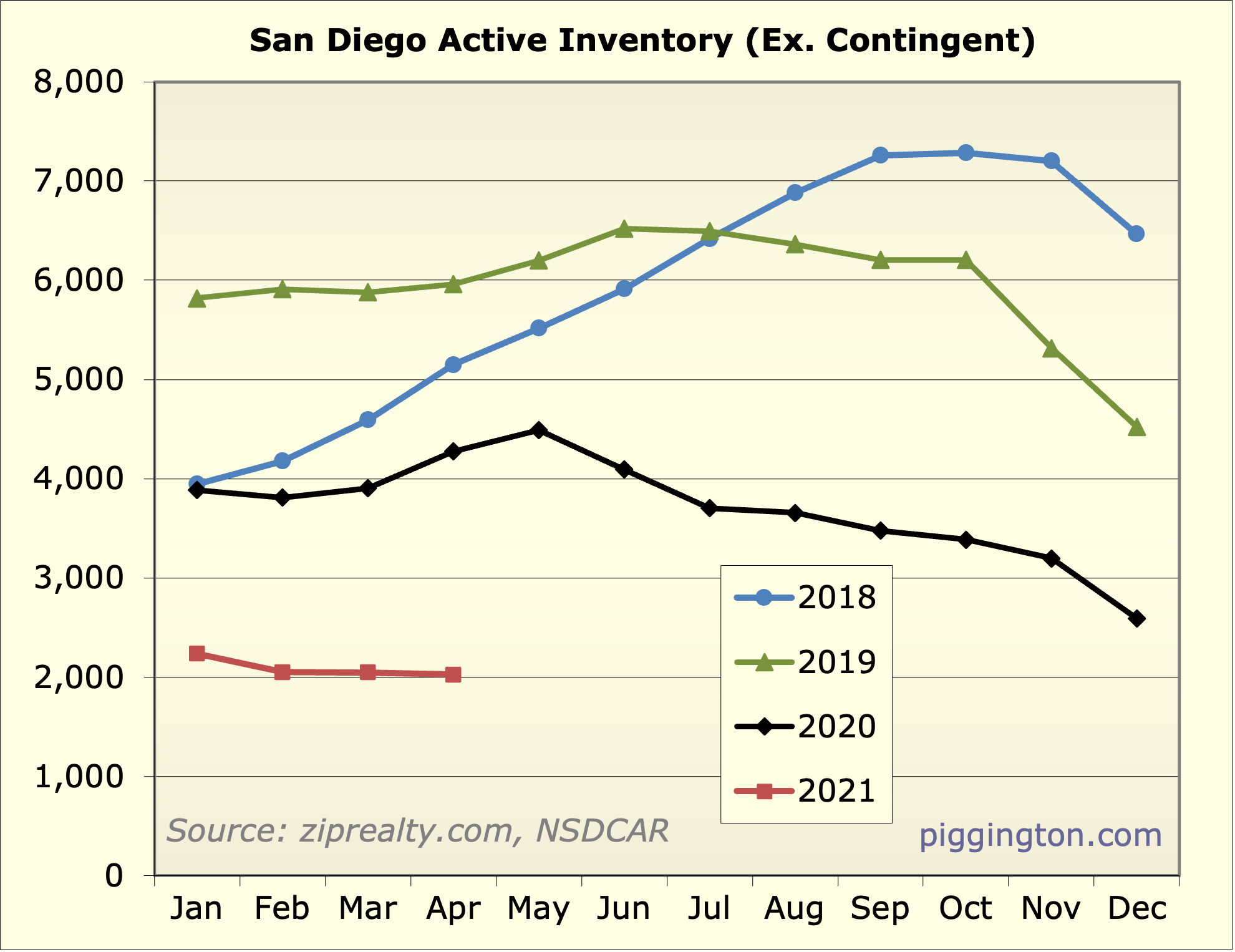

Now here’s supply… half what it was a year ago, and 1/3 what it

was in 2019:

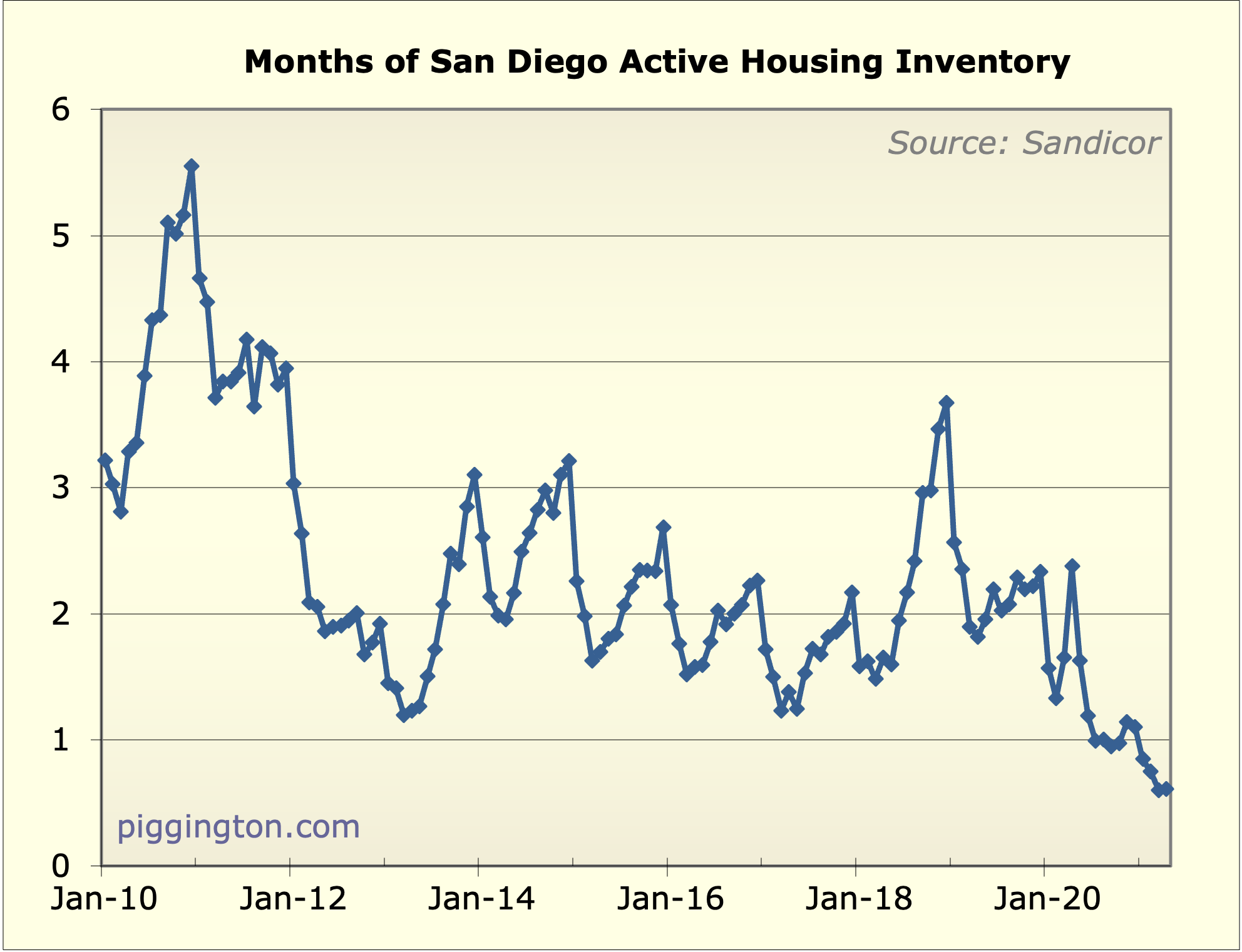

These figures can be combined into months of inventory, which sits

just off its all-time (in my data) low:

And as I love to mention, prices in the short term are very heavily

influenced by this ratio. As shown in this chart (kind of, because

this blowout monthly price number broke my Y axis… just imagine

the red line went up to 54%).

I’m hope to follow up soon with some thoughts on what’s behind the

price increase and how sustainable it is.

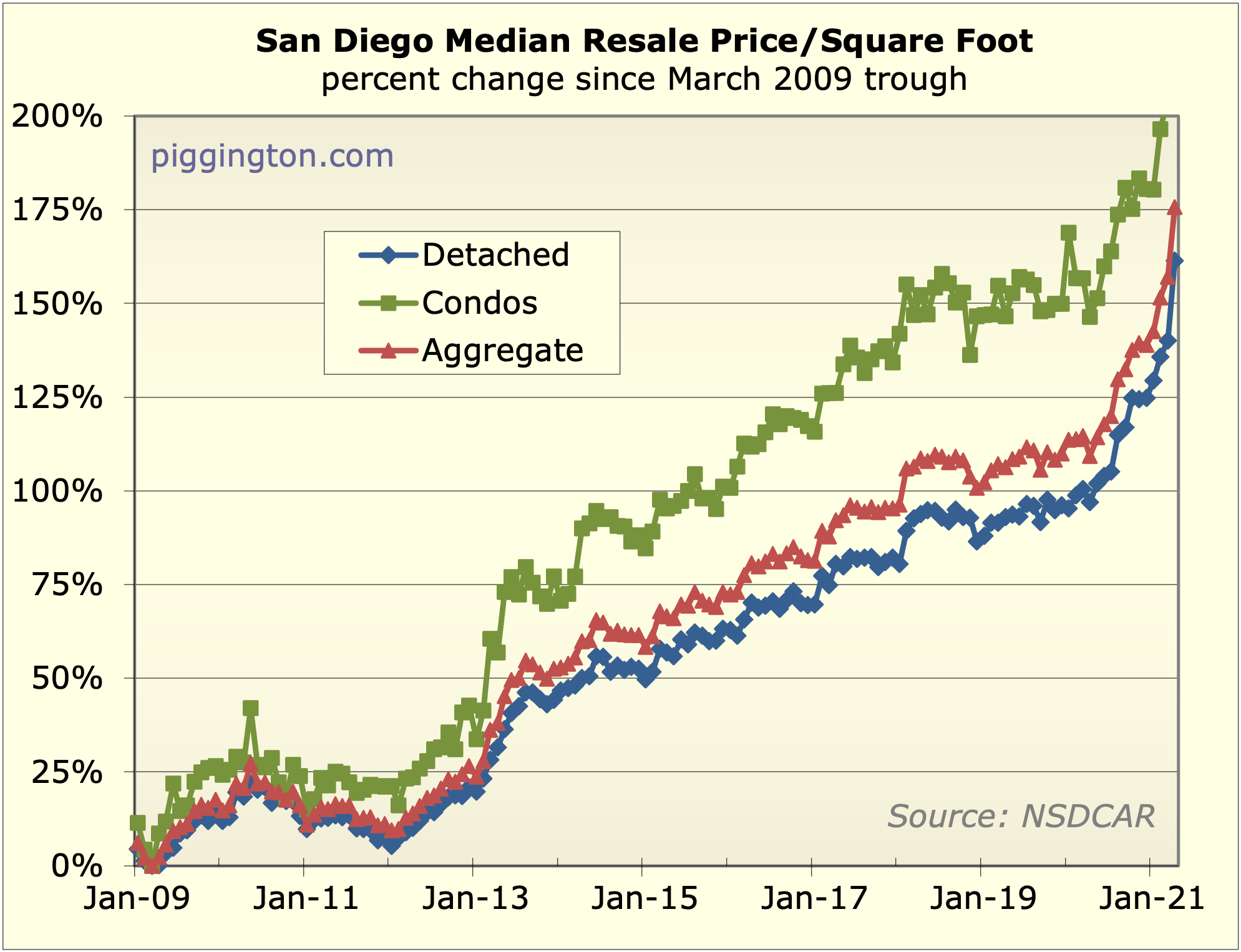

A few more random graphs follow…

Data is finally catching up

Data is finally catching up with what Ive been reporting from the field for a few months. I was seeing single family prices up by 30% many places and now Im seeing them up by 40% in some areas including up by me.

I think you are looking at the data the wrong way. Its more demand driven than it is a lack of supply. The demand number are not telling the picture as they show pending sales. You can only buy what is on the market. Demand is far greater than those pending numbers.

The supply is low but not as low as the graph shows as its based upon inventory not the number of homes coming on the market. Homes are selling in a week or less. The number of homes coming on the market is down maybe 20% not anything close to 1/3 or even 1/2.

Out in the streets we see demand like we never have before. Its caused by two things. Rates are too low and an influx of buyers from higher cost areas who view are prices as bargains are fundamentally changing our markets. The only thing that could slow us down is much higher rates

sdrealtor wrote:I think you

[quote=sdrealtor]I think you are looking at the data the wrong way. Its more demand driven than it is a lack of supply. The demand number are not telling the picture as they show pending sales. You can only buy what is on the market. Demand is far greater than those pending numbers. [/quote]

Yes you have a point there. Low inventory places a limit on volume which causes demand to be understated (if you use volume as a proxy for demand, as I do here). I will need to think about that one.

Nonetheless, it is the case that supply is quite low, yes? The question is how strong demand is, given that volume is being suppressed.

[quote=sdrealtor]

The supply is low but not as low as the graph shows as its based upon inventory not the number of homes coming on the market. Homes are selling in a week or less. The number of homes coming on the market is down maybe 20% not anything close to 1/3 or even 1/2.

[/quote]

They are 2 different things — you are looking at flows, I am looking at stocks. Inventory is the stock (how much is on the market at a given time), new homes are the flow (how much is being added to the inventory over a given period, which of course is offset by homes being sold and being removed from inventory). When I say supply I mean how many homes are available for sale at a given time, so I believe inventory is the correct measure for that. Flows may also be worth looking at, but I’m not sure the significance? Why do you like looking at new supply vs. inventory?

[quote=sdrealtor]

Out in the streets we see demand like we never have before. Its caused by two things. Rates are too low and an influx of buyers from higher cost areas who view are prices as bargains are fundamentally changing our markets. The only thing that could slow us down is much higher rates[/quote]

Certainly agreed on the rate thing. The other thing, the wealthy people… well, it’s definitely plausible, but at the same time it’s often that case that compelling narratives arise to explain bull markets, and I think it’s prudent to question those. So — do you (or anyone reading this) have thoughts on the following:

– Is there actually data to support the idea that wealthy people are moving here from expensive areas? If so, how concentrated is this (eg are they just moving to swanky areas?)

– If the impetus of this inflow is remote work, then shouldn’t we also expect a lot of people to leave San Diego and move to cheaper areas? Is there data on that? (Note: it seems that looking at income data would be a good way to measure the changing composition of the population, if this is indeed happening)

– Kind of a tangent, but does anyone else feel that the remote work thing is overhyped? It’s easy to do at first, when everyone knows each other, but a lot harder when you get new team members, etc. I think we’ve made a major shift towards remote work, but I also think some people may be overestimating how pervasive it will be. If this is right, that also poses a risk to the “rich people moving here” thesis.

Thanks…

Rich, I definitely think this

Rich, I definitely think this remote work thing is overhyped. And like you said, if so many folks are moving to San Diego from higher priced areas, it stands to reason that at least as many, if not many more, would be moving out of San Diego considering San Diego is one of the most expensive places to live in the Country.

The fact is, real estate is nuts everywhere right now, nothing unique to San Diego. Obviously low interest rates is major factor everywhere. But rates have been super low for years. So what’s changed? The Rent and Mortgage moratorium, stimulus checks, PPP loans are a factor. But most importantly trillions of fed money printing. Too much money out there in the hands of the Wall St class and guess what, they are buying up residential real estate.

Clearly this madness is being driven, supported, sustained, etc. by the Federal Reserve. The Fed balance sheet is the only thing that you need to look at to explain everything that is happening. Is this a bubble? Of course it is. But this bubble is being sustained entirely by the Fed’s money printing. It will continue as long as they choose, and it will pop if and when they decide to pop it.

Lots to address here. I think

Lots to address here. I think the difference is you look analyze data that which you can measure, that which you can get data reliably and follow. I’m taking a more organic approach and trying to understand what is actually happening on the street level that is actionable for myself and my clients. I’m looking for inflection points.

When I’m out looking with clients or talking to other agents as I go about my daily business, I am constantly assessing how many people are out there actively looking that we have to compete against. That is demand in my eyes. When I am shopping with them, I am constantly looking at how many and what kind of houses are coming on the market rather than what is on the market at any point in time. The houses on the market at any given point in time, particularly a time like this are usually the stale ones. The good ones come on the market, Have people lining up to see them within an hour and are fielding offers from day one. The flow that will be coming is the supply in my eyes, not the stale inventory sitting on the shelves.

The wealthy thing it’s not something easily measured. I get that from many places. Overtime I meet the changing people in my community. When I talk to agents I ask them where their clients are coming from and what they do all the time. When a house sells, I often look up where the buyers came from. It is not something that is easily measured nor is any part about real estate easily measured. I’ve learned the best market intelligence comes from someone who is paying close attention that is immersed in what is going on. There are a bunch of us out here doing that. There is no single measure that can sum it up.

You asked if it’s only wealthy areas. One thing I do see is areas that were once not so acceptable to the upper middle class professionals gentrifying. Places like Oceanside, Mira Mesa and parts of Chula Vista are good examples of this. this is also the danger of looking at things as a snapshot in time and discounting how powerful, let me repeat and I can’t put enough emphasis on this how powerful the passage of time is. The passage of time is powerful!

as for increased mobility allowing people to leave the less expensive areas? Absolutely! That is exactly the point, we are importing relative wealth and exporting relative poverty (though I would never consider most of those who are leaving as impoverished)

do I think the whole work from home movement is over exaggerated? Absolutely! But this is an example of yet another pitfall I see time in again. it would only take a small percentage of the population working from home I handful of days a month to dramatically change the world. We will see that and more! We don’t need to see everybody working from home five days a week immediately going forward for the real estate world to be turned upside down.

is this happening everywhere? No not everywhere but a lot of places but we are hyper local here and I only care what’s happening here. I moved here in 1991. I almost bought a condo right before I left a very nice upscale community back east with demographics not very different than where I live today. that two bedroom two bath condo would’ve cost me about $110,000 and it rented for $1000 a month back then. I looked it up yesterday and 30 years later it goes for about $150,000 and rents for 1500 a month. I bought my first place in Encinitas in 1997 for $189,000. Today it would go for over $900,000. Simply stated, real estate behaves very different here than most other places

When I read posts by someone like deadzone I chuckle because I run into people like that often. If we went out looking at houses I would recognize that person the first day. Many years ago I was taking to one of the top producing agents up in Carlsbad and trying to negotiate with him. He asked if my clients wanted to buy a house? I was puzzled. Of course they did or so I thought. He explained to me that people who want to buy houses buy houses while other people look for ways to talk themselves out of it. Your clients fall in later category so stop wasting your time with someone that will never buy a home here. He was right. I have observed this 100s of times. Some people look at houses from the perspective of why they wanna buy the house. They see the view, the neighborhood, the yard etc. Others walk around looking for reasons why they don’t wanna buy it. They see the electrical outlet in the wrong place, they see the carpet they would replace day one anyway, they see the ugly light fixture in the guest room. It really is fascinating to watch

sorry for the stream of consciousness post but I’m sitting in my car waiting for something and I’ve got another 20 more minutes so I’ll keep going;)

The idea that the Fed pulling away the punch bowl could cause a crash around here it’s also misguided. Homes are now in the hands of people who committed substantial resources to buy them and financed them at incredibly low rates. while it doesn’t happen in every case here is something I see over and over again. A significant number of people who move out of the area keep their homes as investment properties because they have seen the appreciation, they know the strength of the rental market and hope to return someday. when the markets do go down the strongest take the opportunity to buy their dream home and hold on to their current home as a rental until the market recovers. In the last downtown I saw a bunch of physicians move to La Jolla, Delmar and Rancho Santa Fe while holding on to the Carmel Valley Homes as rentals only to sell them years later when the market recovered.

when I was out looking for homes with a couple clients last fall both ended up with great homes I was more than a little uncomfortable with the price they were paying. However it was the dead of winter and every house we liked enough to write an offer on had 10-20 offers. each time we lost a house I knew we would be facing those same 9 to 19 others who lost it also plus another 3 to 5 new buyers who entered the market each week. It was obvious to me the market was about to explode upward as it did. Thankfully both ended up in great homes that meet all their needs and which they should be happy in for a long time. The six figure appreciation in a few short months only cemented that.

One last thought. Over and over again people try to put this all in black-and-white terms when it is so many shades of gray. I’ve said this many times. We don’t need hundreds of people arriving every month. The arrival of 10 to 20 Motivated buyers from a higher cost area up north is enough to completely change the real estate market along the north county coast and prime areas along the15 corridor. That is all it takes, that and the power of the passage of time

hope this all came out OK dictating it on my phone, I may try to go back later top so some editing to clean it up. sdr out

I’m not claiming the SD RE

I’m not claiming the SD RE market will necessarily crash if you take away the Fed punch bowl, certainly the circumstances are different than 2007.

However, if you can’t see that the crazy increase in prices (everywhere) is a direct result of Fed money printing then you are simply in denial.

This chart is all you need to see. This Fed policy of “monetization” which means basically printing money out of thin air and buying all debt on the market, including residential mortgages and junk bonds of failed companies, not just treasuries, is a new phenomenon. There is no precedent to this and no way to predict how this will end as this experiment has only really happened before in Japan.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm

deadzone wrote:I’m not

[quote=deadzone]I’m not claiming the SD RE market will necessarily crash if you take away the Fed punch bowl, certainly the circumstances are different than 2007.

However, if you can’t see that the crazy increase in prices (everywhere) is a direct result of Fed money printing then you are simply in denial.

This chart is all you need to see. This Fed policy of “monetization” which means basically printing money out of thin air and buying all debt on the market, including residential mortgages and junk bonds of failed companies, not just treasuries, is a new phenomenon. There is no precedent to this and no way to predict how this will end as this experiment has only really happened before in Japan.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm%5B/quote%5D

If you say so dude. Im not commenting on the national economy only the lcoal real estate market. We arent buying homes everywhere, we are buying them here. While it scratches your itch to look at the dark side of things this wont get you closer to a home in SD. I have bought homes here at market bottoms in horrible crashing economies more than a few times. No one ever feels like they are getting a deal around here, it is always uncomfortable unless you are rolling in from silly valley with wads of cash. So keep looking for reasons not to buy a home and you wont ever have that problem. You never will

sdrealtor wrote:deadzone

[quote=sdrealtor][quote=deadzone]I’m not claiming the SD RE market will necessarily crash if you take away the Fed punch bowl, certainly the circumstances are different than 2007.

However, if you can’t see that the crazy increase in prices (everywhere) is a direct result of Fed money printing then you are simply in denial.

This chart is all you need to see. This Fed policy of “monetization” which means basically printing money out of thin air and buying all debt on the market, including residential mortgages and junk bonds of failed companies, not just treasuries, is a new phenomenon. There is no precedent to this and no way to predict how this will end as this experiment has only really happened before in Japan.

https://www.federalreserve.gov/monetarypolicy/bst_recenttrends.htm%5B/quote%5D

If you say so dude. Im not commenting on the national economy only the lcoal real estate market. We arent buying homes everywhere, we are buying them here. While it scratches your itch to look at the dark side of things this wont get you closer to a home in SD. I have bought homes here at market bottoms more than a few times. No one ever feels like they are getting a deal around here, it is always uncomfortable unless you are rolling in from silly valley with wads fo cash. So keep looking for reasons not to buy a home and you wont ever have that problem. You never will[/quote]

Just please stop with your realtor psycho babble. I’m must bringing up the macro reasons why things are happening. We have many analytical folks on this site (or we used to) who appreciate and want to understand why things are happening. There is nothing “dark” about it. Maybe to you it is “dark” since your brain is not able to understand the complex world. That’s fine, in your bubble all you need to know is there are rich people from the bay area buying NCC homes, which is true to some degree. In your position there is no need to understand or care about the bigger picture. But no reason for you to criticize the folks who do.

Exactly what I expect from

Exactly what I expect from you with yet another strawman. Im not commenting on the data being dark, its your perspective that is dark. My brain is perfectly comfortable and competent at understanding the complexities involved and it is you trying to simplify them not I. I just spent a long post explaining a small amount of the complexities involved in our local RE market. Moreso, I understand the national picture and bigger picture. I spend far more time managing investments and caring about the bigger pciture. Most of my assets are invested elsewhere. But thats not what Piggington is. Go up and read the header! Piggington IS San Diego Market News and Analysis! You are moving the goalposts to a national discussion as you have the last decade or so rather than looking at what is happening right at the tip of your nose

And once again for the record, I wish prices were lower. I wish young families could afford homes more easily. I dont have much invested as I never expect to be a seller of my home. The price of it only provides mild amusement to me. Someday my kids will have to deal with it if one of them doesnt make it their home.

DZ: I don’t agree Fed policy

DZ: I don’t agree Fed policy is accurately described as “money printing” like we’re Weimer Germany. It’s switching one dollar denominated asset for another, dollars for treasury bonds that pay so little they are increasingly similar to currency.

We’re in a technological and demographic transition period where the supply of safe and secure investments (like California single family homes) is growing much more slowly than the demand for them. As a result, rates stay low and the price of safe assets goes up, sometimes very fast.

Maybe there will be some crash in the next few years, but personally I think the chance of an insane bubble is higher, and the base case is 5 to 15% price increases for the next 2 years, and the more realistic bear case is just flat prices for a few years, though even that is pretty unlikely.

gzz wrote:DZ: I don’t agree

[quote=gzz]DZ: I don’t agree Fed policy is accurately described as “money printing” like we’re Weimer Germany. It’s switching one dollar denominated asset for another, dollars for treasury bonds that pay so little they are increasingly similar to currency. [/quote]

Are you serious? You’ve need to get out from under that rock your are living under. When the Fed buys securities, Junk bonds from zombie companies that would otherwise go bankrupt for example, they are literally creating new money out of thin air to pay for those securities. Do you folks really not understand this yet? This policy has literally been driving the US economy for over a decade.

Look at this chart of Money supply:

https://fred.stlouisfed.org/series/M1SL

Very similar to the chart of the Fed balance sheet.

Wait I’m sorry, I shouldn’t be talking about National economic issues. As SDR points out, this site is about San Diego RE only. Sure, the San Diego economy is completely independent of any National economic or Federal Reserve policies so those topics should be banned here.

It’s sdr not SDR. Yet another

It’s sdr not SDR. Yet another thing you get wrong

DZ, here’s the same chart for

DZ, here’s the same chart for Switzerland.

https://fred.stlouisfed.org/series/SNBMONTBASE

It is up 20x since 2008.

What’s inflation and interest rates over there during that period?

People are so hard to please sometimes. The Fed has delivered on its mandate of low unemployment and low and stable inflation for 20+ years. Be happy!

gzz wrote:DZ, here’s the same

[quote=gzz]DZ, here’s the same chart for Switzerland.

https://fred.stlouisfed.org/series/SNBMONTBASE

It is up 20x since 2008.

What’s inflation and interest rates over there during that period?

People are so hard to please sometimes. The Fed has delivered on its mandate of low unemployment and low and stable inflation for 20+ years. Be happy![/quote]

Yes Central Banks around the World have been acting together with the QE and money printing. That is the only reason U.S. has gotten away with it.

Although I personally abhor these central bank policies because the primary benefactors are the one percenters and the Wall St elites, that’s not the point. The point is regardless of whether you agree with the policy or not, there is no debate that this money printing is THE reason assets, including RE, are rising around the US (and world).

gzz wrote:DZ, here’s the same

[quote=gzz]DZ, here’s the same chart for Switzerland.

https://fred.stlouisfed.org/series/SNBMONTBASE

It is up 20x since 2008.

What’s inflation and interest rates over there during that period?

People are so hard to please sometimes. The Fed has delivered on its mandate of low unemployment and low and stable inflation for 20+ years. Be happy![/quote]

One obvious, huge difference in the M1 chart for U.S. and Switzerland is since the Pandemic started, Swiss money supply has only increased about 40% while U.S. money supply has increased about 400%.

As a result, the Swiss housing market has stabilized while the U.S. housing market is bat shit crazy. If you are a fan of the housing market (and all asset markets) being bat shit crazy, then you should be very happy with the Fed

deadzone wrote:If you are a

[quote=deadzone]If you are a fan of the housing market (and all asset markets) being bat shit crazy, then you should be very happy with the Fed[/quote]

I’m f**king ecstatic with the Fed. Bring on the 70s!!!

sdrealtor wrote:

is this

[quote=sdrealtor]

is this happening everywhere? No not everywhere but a lot of places but we are hyper local here and I only care what’s happening here. I moved here in 1991. I almost bought a condo right before I left a very nice upscale community back east with demographics not very different than where I live today. that two bedroom two bath condo would’ve cost me about $110,000 and it rented for $1000 a month back then. I looked it up yesterday and 30 years later it goes for about $150,000 and rents for 1500 a month. [/quote]

Not buying any of this. Where is this place that has appreciated only 36% in 30 years? Fantasyland I say.

$1000 a month rent was A LOT 30 years ago, even here. That’s nonsensical.

Reality wrote:sdrealtor

[quote=Reality][quote=sdrealtor]

is this happening everywhere? No not everywhere but a lot of places but we are hyper local here and I only care what’s happening here. I moved here in 1991. I almost bought a condo right before I left a very nice upscale community back east with demographics not very different than where I live today. that two bedroom two bath condo would’ve cost me about $110,000 and it rented for $1000 a month back then. I looked it up yesterday and 30 years later it goes for about $150,000 and rents for 1500 a month. [/quote]

Not buying any of this. Where is this place that has appreciated only 36% in 30 years? Fantasyland I say.

$1000 a month rent was A LOT 30 years ago, even here. That’s nonsensical.[/quote]

https://www.redfin.com/NJ/Cherry-Hill/405-The-Woods-08003/home/36064502?utm_source=ios_share&utm_medium=share&utm_campaign=copy_link&utm_nooverride=1&utm_content=link

Rent is from memory and may have been $800 but close enough and I think it was around $1000. My hometown. These were around 60k when new in 84 and rates were in mid teens. By early 90’s rates were down and they were low 100s. Now they are 150k.

One mile down the road is my high school. I graduated with about 825 students. I’d estimate 100 went on to ivy league schools. Well over 90% to 4 year colleges. My neighbors were all doctors, lawyers, business owners, RCA engineers, professional athletes etc. Muhammad Ali lived there and used to show up at our little League games. Regularly ran into Phillies, Eagles, Flyers and Sixers. Have autographs to prove it. One of my neighbors and childhood friends is married to Biden’s daughter now. It’s a very real place. Median HH income is about 110k currently. That’s 10% higher than where I live now in 92009. I’d say Go back in your house but you failed to capitalize on the opportunity of a lifetime so I’ll just say go back in your hole

Cherry Hill East is a good

Cherry Hill East is a good area. My brother lives nearby in Delanco. 2/2 1,000sq ft. townhome built in 2007 he moved into new for under 100k. Just looked and they go for 150k now. He’s right on the Delaware river and schools are good.

My parent’s 4/2.5 2100sq ft. home on 1+ acre outside of Princeton was purchased for 207k in 1986 when mortgage rates were 12%!

Comps on their street are 500k-550k. Top public schools that everyone wants in on.

Yup, five of my friends went

Yup, five of my friends went to Princeton. A handful to Harvard. Over 30 to Penn, might have been 50+. Sent kids to every ivy. CHE was and still is amazing school.

Parents bought in 64 for 27k. Sold in 88 for 220k. It resold in 01 for the same. Now maybe 400k, maybe. Houses did better than condos but still not compared to inflation and annual maintenance is much higher there

My high school basketball

My high school basketball team played at CHE when I was on the team in the early 2000s and I remember seeing dozens of swimming state championship banners hanging. Their basketball team was very good then as well.

One of the greatest high

One of the greatest high school games of all time was my Sr year against our arch rivals in Camden we could never beat. We were #2 to them locally and they were #1 nationally also. Two guys on the Camden team went on to play for the Lakers. It was in the early days of cable and the first time they got to play on TV. It was like a slam dunk contest for them

That Camden team went to state finals and was upset by Neptune at Jadwin gym in Princeton. They filled the aisles and standing room to the court sides. I was there and it was insanity. Amazing memory of mine

sdrealtor wrote: I’d estimate

[quote=sdrealtor] I’d estimate 100 went on to ivy league schools. Well over 90% to 4 year colleges. My neighbors were all doctors, lawyers, business owners, RCA engineers, professional athletes etc.

[/quote]

Wow, brag much SDR? What ivy league school did you get your Psychology degree from?

Coming from the biggest loser

Coming from the biggest loser here that means little. All you have is ad hominem attacks. So sad. He called my post nonsense and fantasy, I proved otherwise with hard facts and data. Everything I post I can verify. Oh and no ivy for me. Graduated from Rutgers undergraduate school of business with double major in accounting and economics

sdrealtor wrote:Coming from

[quote=sdrealtor]Coming from the biggest loser here that means little. All you have is ad hominem attacks. So sad. He called my post nonsense and fantasy, I proved otherwise with hard facts and data. Everything I post I can verify. Oh and no ivy for me. Graduated from Rutgers undergraduate school of business with double major in accounting and economics[/quote]

It is both amusing and pathetic to watch you continue to repeat the same behavior when anyone on this board calls you out.

1. go off on some tangent to include healthy dose of bragging and patting yourself on the back.

2. Use a healthy dose of tired cliches (strawman, ad hominem, “opportunity of a lifetime”, etc)

3. Culminate with some sort of insult, attack or generally mean-spirited response (“Loser”, “Get Back in your Hole”).

It is interesting to note that when Rich called out your BS multiple times recently you never responded or if you did, you responded with a whimper.

Actually I answered all of

Actually I answered all of Rich’s questions thoroughly and respectfully as I always do. I clarified and provided data as I always do. Just like I do for pretty much everyone else but you and your permabear buddy reality. You need to follow closer.

The funny part is you amuse me. We have been doing this dance every once in a while for 15 years. You have yet to claim a single victory. You have quite literally been wrong every…. single… time. Please show me a single time we have gone head to head where you were right? Im just calling a spade a spade. You have never been a winner. Not once LOL

sdrealtor wrote:Actually I

[quote=sdrealtor]Actually I answered all of Rich’s questions thoroughly and respectfully as I always do. I clarified and provided data as I always do. Just like I do for pretty much everyone else but you and your permabear buddy reality. You need to follow closer.

The funny part is you amuse me. We have been doing this dance every once in a while for 15 years. You have yet to claim a single victory. You have quite literally been wrong every…. single… time. Please show me a single time we have gone head to head where you were right? Im just calling a spade a spade. You have never been a winner. Not once LOL[/quote]

I didn’t realize we were in a competition. But if there is a competition for all time biggest douche on Piggington, you get first prize hands down! So you can congratulate yourself on that among all of the other awards that you have given to yourself.

sdrealtor wrote:Actually I

[quote=sdrealtor]Actually I answered all of Rich’s questions thoroughly and respectfully as I always do. I clarified and provided data as I always do. Just like I do for pretty much everyone else but you and your permabear buddy reality. You need to follow closer.

The funny part is you amuse me. We have been doing this dance every once in a while for 15 years. You have yet to claim a single victory. You have quite literally been wrong every…. single… time. Please show me a single time we have gone head to head where you were right? Im just calling a spade a spade. You have never been a winner. Not once LOL[/quote]

I didn’t realize we were in a competition. But if there is a competition for all time biggest douche on Piggington, you get first prize hands down! So you can congratulate yourself on that among all of the other awards that you have given to yourself.

Duly noted

Duly noted

I’m new here but I just want

I’m new here but I just want to say, you guys (sdrealtor & deadzone) are the best. I know you maybe got a little heated in conversation but I’ve been cracking up the whole time while getting valuable insight/opinions from both.

davidp10 wrote:I’m new here

[quote=davidp10]I’m new here but I just want to say, you guys (sdrealtor & deadzone) are the best. I know you maybe got a little heated in conversation but I’ve been cracking up the whole time while getting valuable insight/opinions from both.[/quote]

Glad to be of service, maybe me and sdr should take our show on the road. But seriously you make an important point, having differing opinions and perspectives is key or else this site would be worthless.

sdrealtor wrote:Reality

[quote=sdrealtor][quote=Reality][quote=sdrealtor]

is this happening everywhere? No not everywhere but a lot of places but we are hyper local here and I only care what’s happening here. I moved here in 1991. I almost bought a condo right before I left a very nice upscale community back east with demographics not very different than where I live today. that two bedroom two bath condo would’ve cost me about $110,000 and it rented for $1000 a month back then. I looked it up yesterday and 30 years later it goes for about $150,000 and rents for 1500 a month. [/quote]

Not buying any of this. Where is this place that has appreciated only 36% in 30 years? Fantasyland I say.

$1000 a month rent was A LOT 30 years ago, even here. That’s nonsensical.[/quote]

https://www.redfin.com/NJ/Cherry-Hill/405-The-Woods-08003/home/36064502?utm_source=ios_share&utm_medium=share&utm_campaign=copy_link&utm_nooverride=1&utm_content=link

Rent is from memory and may have been $800 but close enough and I think it was around $1000. My hometown. These were around 60k when new in 84 and rates were in mid teens. By early 90’s rates were down and they were low 100s. Now they are 150k.

One mile down the road is my high school. I graduated with about 825 students. I’d estimate 100 went on to ivy league schools. Well over 90% to 4 year colleges. My neighbors were all doctors, lawyers, business owners, RCA engineers, professional athletes etc. Muhammad Ali lived there and used to show up at our little League games. Regularly ran into Phillies, Eagles, Flyers and Sixers. Have autographs to prove it. One of my neighbors and childhood friends is married to Biden’s daughter now. It’s a very real place. Median HH income is about 110k currently. That’s 10% higher than where I live now in 92009. I’d say Go back in your house but you failed to capitalize on the opportunity of a lifetime so I’ll just say go back in your hole[/quote]

That one doesn’t show any real old sales except 1984.

This one sold for 73k in 1992 now on the market for 165k. A bit more than double and now the rent went from 800-1500 per your latest estimation.

https://www.zillow.com/homedetails/1814-The-Woods-II-Cherry-Hill-NJ-08003/63679064_zpid/

I’m bullish on real estate in general, especially in CA, but you’ll never convince me that what’s happened in the last year is anything but a Fed ignited bubble that’s nationwide.

Also no need to hurl insults and BTW the opportunity of a lifetime was the 1990s.

Different complex. It’s Woods

Different complex. It’s Woods 2, I was looking at Woods 1. Those are bigger and nicer location. They sell for more and the 165k price today is why it’s higher. As for the 1992 price I am certain that is an outlier. I remember there was a fire there around them and that could be one of the impacted units. Whatever the case it was not representative of general market back then.

No one is disputing low rates are fueling this. I’m hoping for higher rates as they are only thing that can get this under control. What is being disputed is that what is happening here is happening everywhere. It’s not. Our market is an outlier relative to most of the country.

And I bought two properties here in the late 90s. Yes it was a great opportunity but rates were much higher and it wasn’t obvious how good it was. In the period from 2009-2011, rates were lower, deals were to be found everywhere and it was obvious where we would be going in several years. We had already been there. So I still think that was the opportunity of a lifetime and I was active in both markets

sdrealtor wrote:

What is

[quote=sdrealtor]

What is being disputed is that what is happening here is happening everywhere. It’s not. Our market is an outlier relative to most of the country.

[/quote]

Bullcrap, National Case Shiller is up 12% in the last year. Yes San Diego is a bit higher than that, as Coastal/warm cities always have more desirability factor. But clearly this is a national phenomenon. There are record prices, bidding wars, etc. in cities all over the Country. Try spending a little more time researching other areas and less time trying to enforce your authority on this blog.

That’s what I see as well,

That’s what I see as well, there are significant number of folks from really expense mkts such bay area who have been buying here due to better remote work options. For a bay area family ~1.2 -1.5M for a 2000 sqft home in a great neighborhood with good schools is good deal, something they are willing to pay. Some folks are even willing to stay away from their families half the month while they work on-site in bay area but feel the quality of life for their family is much better in parts of SD they live (NCCC, 4S, SR etc.)

However, this surge in home prices is happening in many cities across the country, a friend of mine just mentioned that Scottsdale, AZ is up 40% YOY, that does seem to be true. There are a number of cities across the country where prices are up +30% YOY… hopefully with more supply and interest rate increase things will cool down with some correction.

One other point that is an

One other point that is an artifact of how data comes in and is reported with a lag. That 9% spike in prices really came in February. That month was wild! From start to finish prices skyrocketed in February. With the data that gets smoothed out over a month (some sell early in the month at lower prices while others sell at end of month at the higher prices). It became the new normal for homes coming on the market in March which was a full month at those levels. Then it takes about 30 days for them to close, so they show up as April closed sale data. Buying and selling a home in February 2021 was one for the books!

Is this what happens to the

Is this what happens to the housing market when inflation is happening or expected?

I wish we had data from the 70s/80s to compare.

A house is a perfect hedge against inflation, especially with 30 years mortgages.

My debt will be halved in 14 years at 5% inflation, but my house price will double.

I’ve been watching the market

I’ve been watching the market closely still my first thought was “dear lord!”

Agree with sdrealtor, there is more to this on the demand side of things but I think even the chart above may be overstating the supply once certain criteria for a normal millionaire buyer are factored. (3BR+, min 1750 sf)

My question is though, how many buyers are out there who see 1.5M as a reasonable target, is it 50K? 100K

There are 18.6 millionaires in the US.

I read stats which show 170K millionaires in SF/San Jose.

270K in LA. 116K in Orange county.

About 102K millionaries in San Diego.

So with only 550 or so 3BR+ SFH/Condos under 1.5M with 1750 sf+, there really isn’t much to choose from if only 1% move from these three markets to SD.

Even this includes a fair number in Ramona/Alpine.

If I box in from the 76 down to National City and just go 5 miles west of I-15, then the total below 1.5M drops to 371.

Literally a few planeloads of buyers could pick up everything in the upper-middle market (800K to 1.5M).

So while there may be 2,000 homes/condos on the market county wide, many are either above 1.5M or only 1BR/2Br or less than 1750 sf.

Longer term, I do see more supply coming from older boomers who have retired in place but on balance I think greater than 50% will retain the properties in the families. Many of these are the 102K millionaires currently in SD but think that will take 20-30 years to fully play out which implies at 3-5K unit per year average number of units hitting the market or 250-400 monthly. if we take 50%, then 125-200 homes. That’s not much to keep the realtors busy, will definitely be a survival of the fittest market.

So 100K buyers would be needed over 20-30 years to keep things in equilibrium, probably not an unreasonable forecast. If anything this may be understating potential due to 2nd homes etc.

Escoguy wrote:I’ve been

[quote=Escoguy]I’ve been watching the market closely still my first thought was “dear lord!”

Agree with sdrealtor, there is more to this on the demand side of things but I think even the chart above may be overstating the supply once certain criteria for a normal millionaire buyer are factored. (3BR+, min 1750 sf)

My question is though, how many buyers are out there who see 1.5M as a reasonable target, is it 50K? 100K

There are 18.6 millionaires in the US.

I read stats which show 170K millionaires in SF/San Jose.

270K in LA. 116K in Orange county.

About 102K millionaries in San Diego.

So with only 550 or so 3BR+ SFH/Condos under 1.5M with 1750 sf+, there really isn’t much to choose from if only 1% move from these three markets to SD.

Even this includes a fair number in Ramona/Alpine.

If I box in from the 76 down to National City and just go 5 miles west of I-15, then the total below 1.5M drops to 371.

Literally a few planeloads of buyers could pick up everything in the upper-middle market (800K to 1.5M).

So while there may be 2,000 homes/condos on the market county wide, many are either above 1.5M or only 1BR/2Br or less than 1750 sf.

Longer term, I do see more supply coming from older boomers who have retired in place but on balance I think greater than 50% will retain the properties in the families. Many of these are the 102K millionaires currently in SD but think that will take 20-30 years to fully play out which implies at 3-5K unit per year average number of units hitting the market or 250-400 monthly. if we take 50%, then 125-200 homes. That’s not much to keep the realtors busy, will definitely be a survival of the fittest market.

So 100K buyers would be needed over 20-30 years to keep things in equilibrium, probably not an unreasonable forecast. If anything this may be understating potential due to 2nd homes etc.[/quote]

Been saying for months. 10-20 bay area/LA buyers a month can dramatically change the markets in NCC/4s/del sur / Carmel Valley. That’s all it would take and it has happened

And inventory is far more limited than your cuts. They are coming for houses with nice yards on top school districts. The action there is nuts

sdrealtor wrote:Been saying

[quote=sdrealtor]Been saying for months. 10-20 bay area/LA buyers a month can dramatically change the markets in NCC/4s/del sur / Carmel Valley. That’s all it would take and it has happened

And inventory is far more limited than your cuts. They are coming for houses with nice yards on top school districts. The action there is nuts[/quote]Yep, they’ve been so used to much higher cost and lower performing schools.

Thanks Rich for posting!

Thanks Rich for posting! Really appreciated. I agree a discussion on the sustainability of the pricing situation is warranted.

I know there have been divergent opinions on interest rates but for now with negative rates in Europe/Japan, and hedged US dollar rates being positive for investors/savers from those countries, I see a mid term cap on rates (next 3-5 years). Long term demographics globally also lend themselves to lower rates:

https://www.bloomberg.com/opinion/articles/2021-05-14/inflation-the-real-reason-why-u-s-bond-yields-are-stuck?sref=AtMgUiWa

https://www.frbsf.org/economic-research/files/4-Thwaites-demographic-trends-and-the-real-interest-rate.pdf Quote “We find that the ageing of the aggregate advanced- country population can explain 45% of the roughly 360 bp fall in global real interest rates since 1980. Demographic pressures are forecast to reduce real interest rates a further 37 bp by 2050.”

Boomers are not going to help

Boomers are not going to help supply. They are happily aging in place, and boomers with houses in the suburbs mostly have 2 or 3 kids who might move in.

Mt. Helix 91941 might be the most boomer-tastic neighborhood in San Diego since so much of it was built 1965-1995 and residents tended to settle down long term there.

Currently there are 15 SFH for sale and about 35 sales in the past 30 days, so 0.43 month supply.

About 20% of boomer women

About 20% of boomer women never had kids as a potential data point.

gzz wrote:Boomers are not

[quote=gzz]Boomers are not going to help supply. They are happily aging in place, and boomers with houses in the suburbs mostly have 2 or 3 kids who might move in.

Mt. Helix 91941 might be the most boomer-tastic neighborhood in San Diego since so much of it was built 1965-1995 and residents tended to settle down long term there.

Currently there are 15 SFH for sale and about 35 sales in the past 30 days, so 0.43 month supply.[/quote]

Thing about Mt Helix is that area did and still does appeal to more blue collar and folks that like space for the their toys. They can’t go anywhere around here without giving up that space so more prone to stay forever. Coastal boomers are more mobile and many dream of Downsizing from big house east of five to something walkable to beach including condos and can afford to

Is it a bubble? No. But I’m

Is it a bubble? No. But I’m all nice and ready for one!

All these obscure new companies based in California now worth 10, 50, 100 billion! Has 1 American in 100 even heard of Twilio or ServiceNow? Yet they created billionaires, plus many many deco-millionaires.

Money from all over the world is gushing into California companies. When you consider how much wealth has been created here in the past 5 to 10 years, and then further consider the “normal” share of wealth people want to put into their primary residence, prices are actually pretty low, especially in the bay area, but here too.

One of my clients was an exec

One of my clients was an exec at Twiliois. A few years ago I told him he was nuts to spend what he did ($2M+) where he did to stay in school district for his daughter. He said it wouldnt matter soon. He was right

gzz wrote:Is it a bubble? No.

[quote=gzz]Is it a bubble? No. But I’m all nice and ready for one!

All these obscure new companies based in California now worth 10, 50, 100 billion! Has 1 American in 100 even heard of Twilio or ServiceNow? Yet they created billionaires, plus many many deco-millionaires.

Money from all over the world is gushing into California companies. When you consider how much wealth has been created here in the past 5 to 10 years, and then further consider the “normal” share of wealth people want to put into their primary residence, prices are actually pretty low, especially in the bay area, but here too.[/quote]

I agree that housing isn’t a bubble, but the rest of your post boils down to using a bubble as the denominator for home prices.

Rich Toscano wrote:the rest

[quote=Rich Toscano]the rest of your post boils down to using a bubble as the denominator for home prices.[/quote]

Not really. Tech valuations could drop another 50%, and the share of net worth devoted to real estate by tech investors and employees with vested options would still be crazy low. My share of net worth in my primary residence is about 1/3, and was over 100% when I purchased it.

There are a lot of people in California worth $5+ million who are still renting. Or who could buy a nice house and have it be 10% or less of their net worth.

Where else do you have that? Where else do you have that and a very tight market that’s very supply constrained in both the short and long term? And low property taxes that encourage buy and hold? And low rates to finance it, and the SALT and MI deductions likely to be increased, further encouraging buying residential RE.

Some will leave, some will stay renters because of lifestyle, but I think a lot of them will sell 10-25% of their shares and settle down and buy.

33% YoY, wow I’m rich. Why

33% YoY, wow I’m rich. Why did I show up to work today when it appears my homes are going up in value by $10k+ daily?

Lots of nohouser FUD in this thread. You’ll feel better if you JOIN US. If only you knew a San Diego-area realtor!

Phoenix metro is also up 33%

Phoenix metro is also up 33% YoY.

https://armls.com/docs/sold-list-chart.pdf

gzz wrote:Phoenix metro is

[quote=gzz]Phoenix metro is also up 33% YoY.

https://armls.com/docs/sold-list-chart.pdf%5B/quote%5D

Not possible, I don’t believe it. SDR assured me this is strictly a San Diego phenomenon.

Liar. I said most of the

Liar. I said most of the country. Phoenix is #1 and SD is #2 and should be #1 soon. Stop making sh*t up in your parents garage studio apartment

sdrealtor wrote:Liar. I said

[quote=sdrealtor]Liar. I said most of the country. Phoenix is #1 and SD is #2 and should be #1 soon. Stop making sh*t up in your parents garage studio apartment[/quote]

Actually I am in my home office looking out over the ocean view as I type this.

You stop making sh*t up. And stop arguing for arguments sake. Folks on this site are starting to tire of your BS.

deadzone wrote:sdrealtor

[quote=deadzone][quote=sdrealtor]Liar. I said most of the country. Phoenix is #1 and SD is #2 and should be #1 soon. Stop making sh*t up in your parents garage studio apartment[/quote]

Actually I am in my home office looking out over the ocean view as I type this.

You stop making sh*t up. And stop arguing for arguments sake. Folks on this site are starting to tire of your BS.[/quote]

Picture or its another lie

Even Utah housing is up 23%.

Even Utah housing is up 23%. Bidding wars. No clement weather, no beaches yet same housing shortage.

https://www.deseret.com/2021/5/13/22412416/utahs-place-in-the-west-raging-housing-market-salt-lake-city-rising-housing-prices-record-breaking

Seattle? Texas? SD doesn’t seem to be an outlier.

pinkflamingo wrote:Even Utah

[quote=pinkflamingo]Even Utah housing is up 23%. Bidding wars. No clement weather, no beaches yet same housing shortage.

https://www.deseret.com/2021/5/13/22412416/utahs-place-in-the-west-raging-housing-market-salt-lake-city-rising-housing-prices-record-breaking

Seattle? Texas? SD doesn’t seem to be an outlier.[/quote]

Hey you better stop lying or sdr is going to get angry at you.

Even Utah housing is up

That’s the Q1 YoY figure. Rich’s SD figure and my Phoenix figure are April 2021 YoY numbers.

At least in the case for San Diego, this makes a difference. Rich’s Feb figure was up 19%, so that’s more of an apples-to-apples comparison with the Utah Q12020 to Q12021 figure. Though I note the 23% was a smaller exurban county, and Salt Lake Co was up 17%.

The national figure for April YoY is 19.1%:

https://www.nar.realtor/newsroom/existing-home-sales-decline-2-7-in-april

While it might feel good to think SD is uniquely strong, the bull market covering most of the USA is a very positive thing, since it means that our price increases are not making competing markets relatively good values.

The average Phoenix metro house is now about 500k, WOW. Sure SD homeowners can always get a better valuing moving to the desert, but it wasn’t long ago a newer 5-bedroom mcmansion with pool in Scottsdale was $350k!

Now here’s what $950k gets you. Not bad, but hardly a lux palace worth uprooting yourself for either.

https://www.zillow.com/homedetails/13059-E-Poinsettia-Dr-Scottsdale-AZ-85259/8057194_zpid/

Now here’s what $950k gets

Now here’s what $950k gets you. Not bad, but hardly a lux palace worth uprooting yourself for either.

https://www.zillow.com/homedetails/13059…

Interesting… that house sold for ~478K summer of 2018, listed for 950K now, 100% gain in 3 yrs. If this isn’t a bubble, not sure what would account for bubble.

Andy, while Phoenix went up

Andy, while Phoenix went up big lately, I noticed a few places below 2006 prices. In SD we’re way above that.

A fun graph would be San Diego median price as a % of other major cities. No nominal prices or price changes, only price ratios between cities.

I felt like from about 2015-2019, SD was under-performing peer markets, so we’re due some monster gains around now.

Just got out my weekly

Just got out my weekly webinar with a socal housing economist I follow. Here’s something that stood out. New listings hitting the market are way down vis a vis the 5 yr average and its getting worse.

In the first 2 weeks of May we are down 19% on new homes hitting the market in the 5 county SoCal market when compared to the 5 yr average. Those figures by county range from a low of down 14% in LA County to a high of down 24% in SD County. Even in SoCal its worse here than the other socal submarkets.